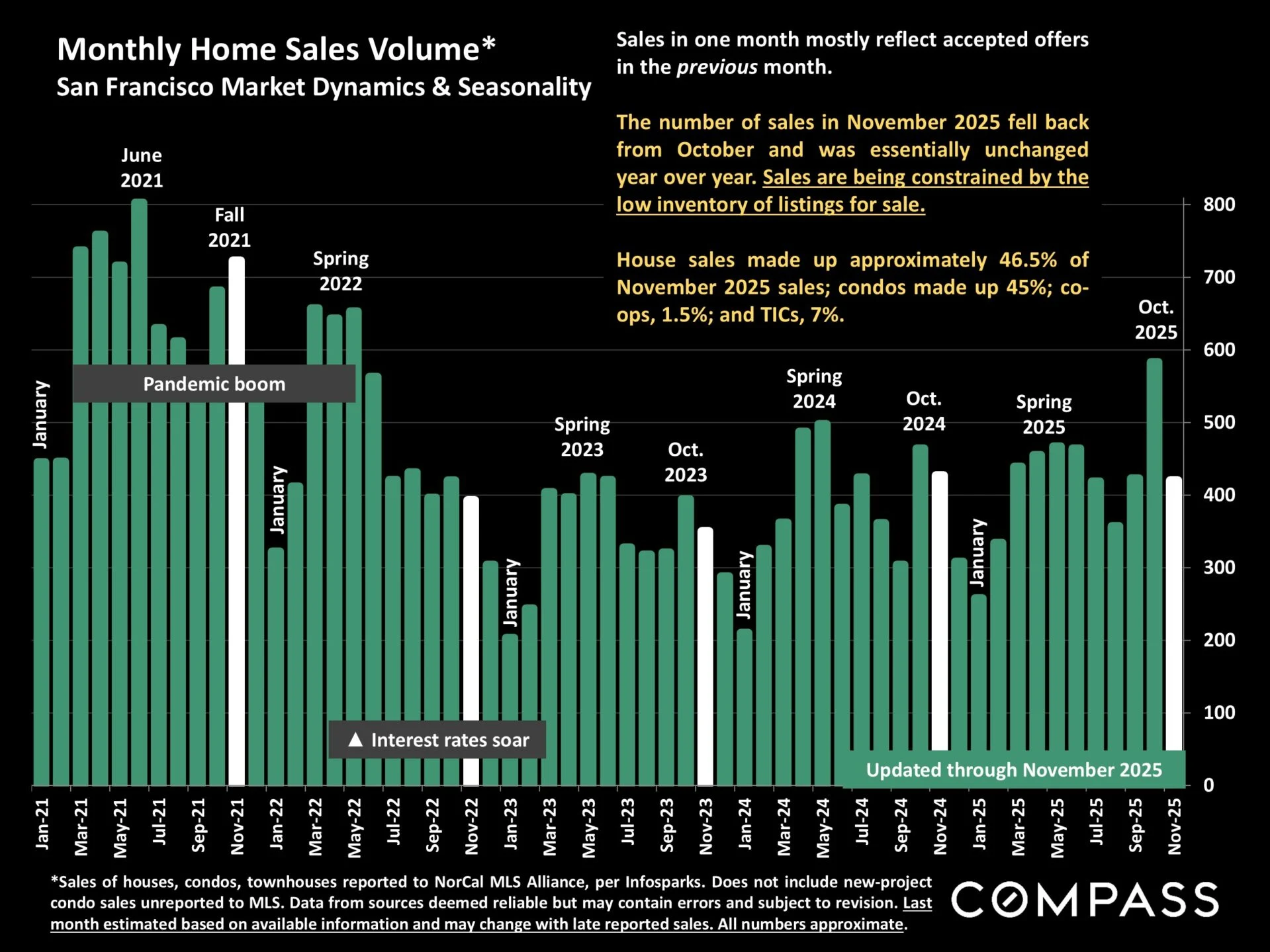

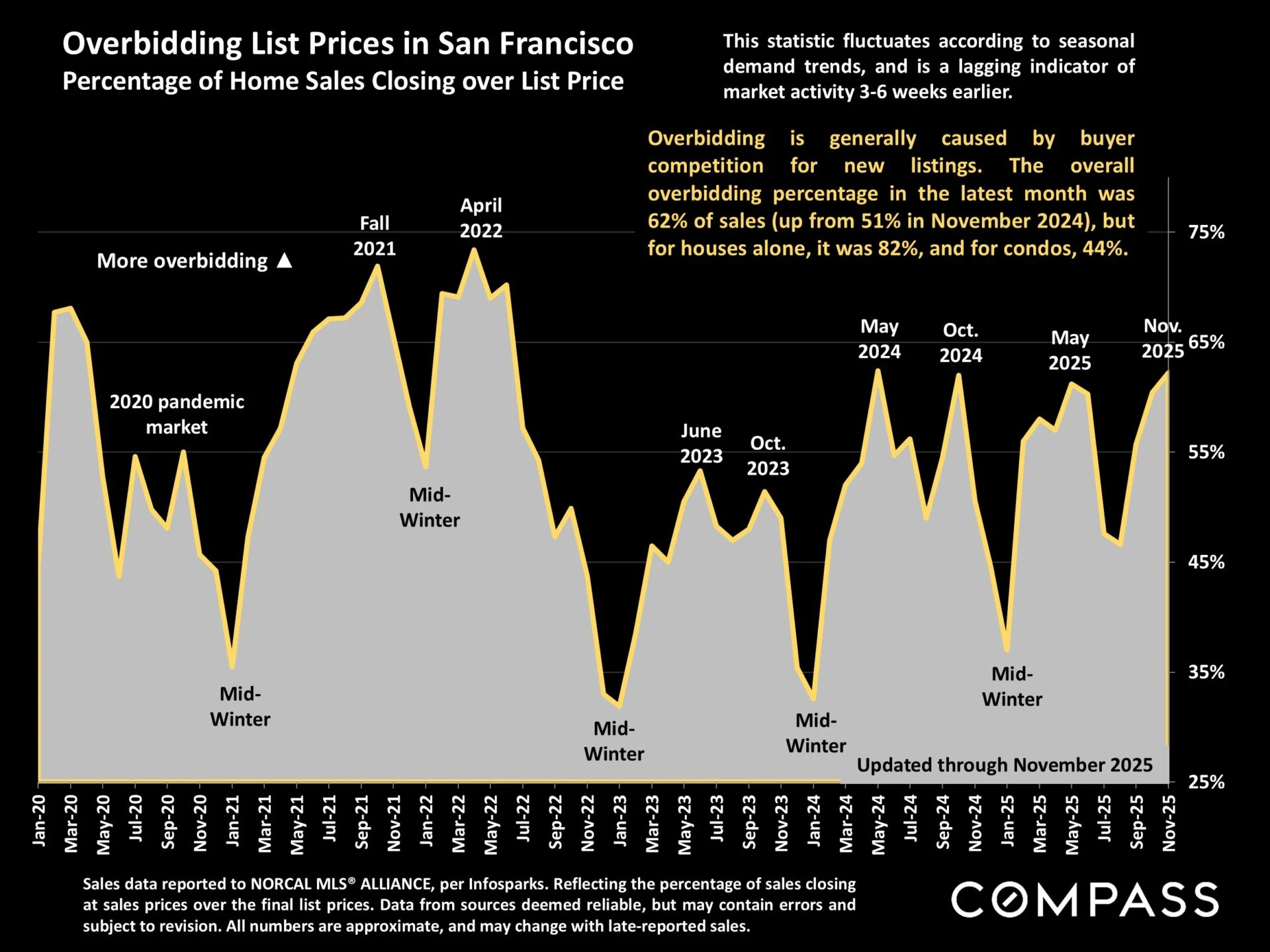

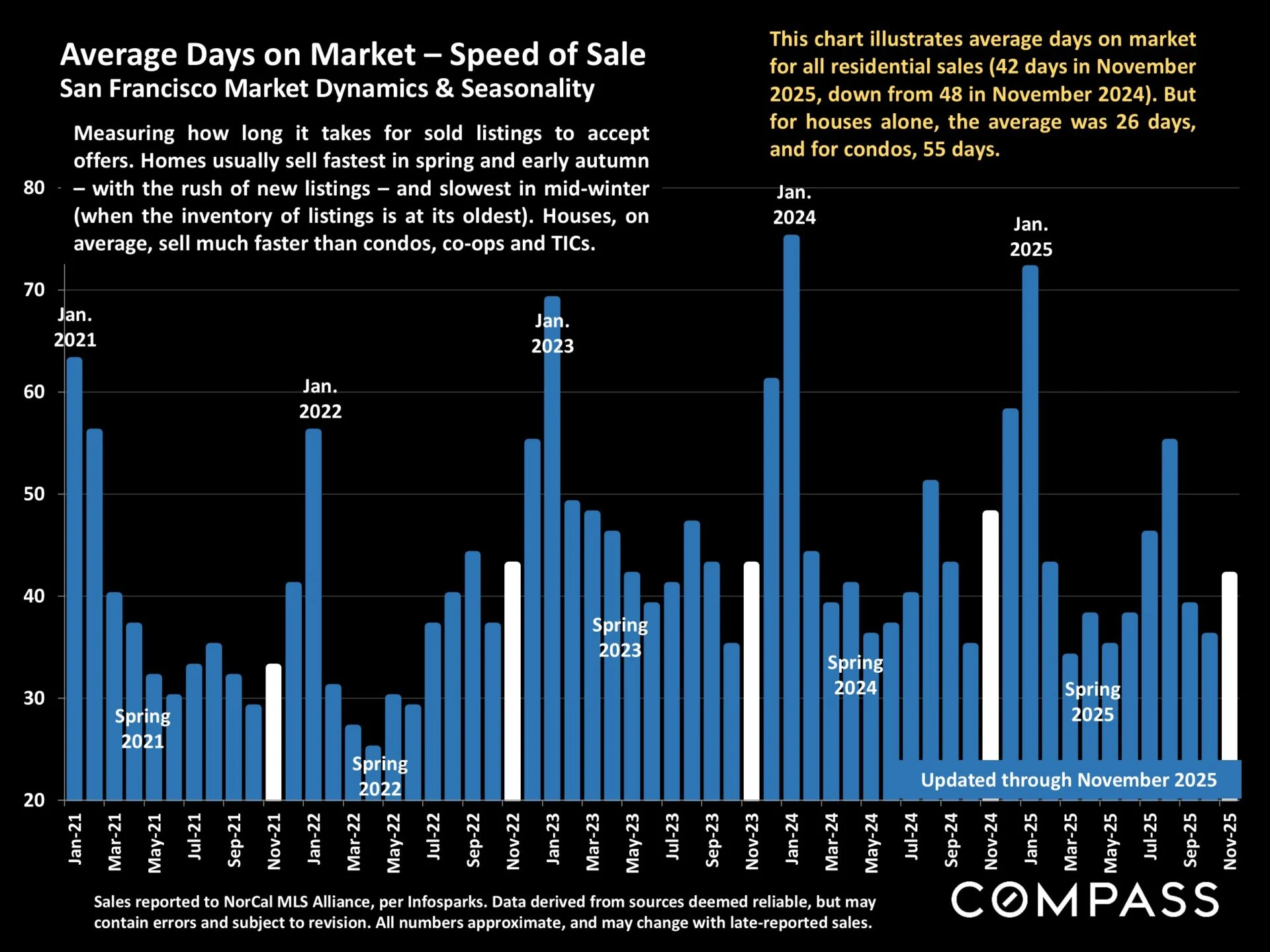

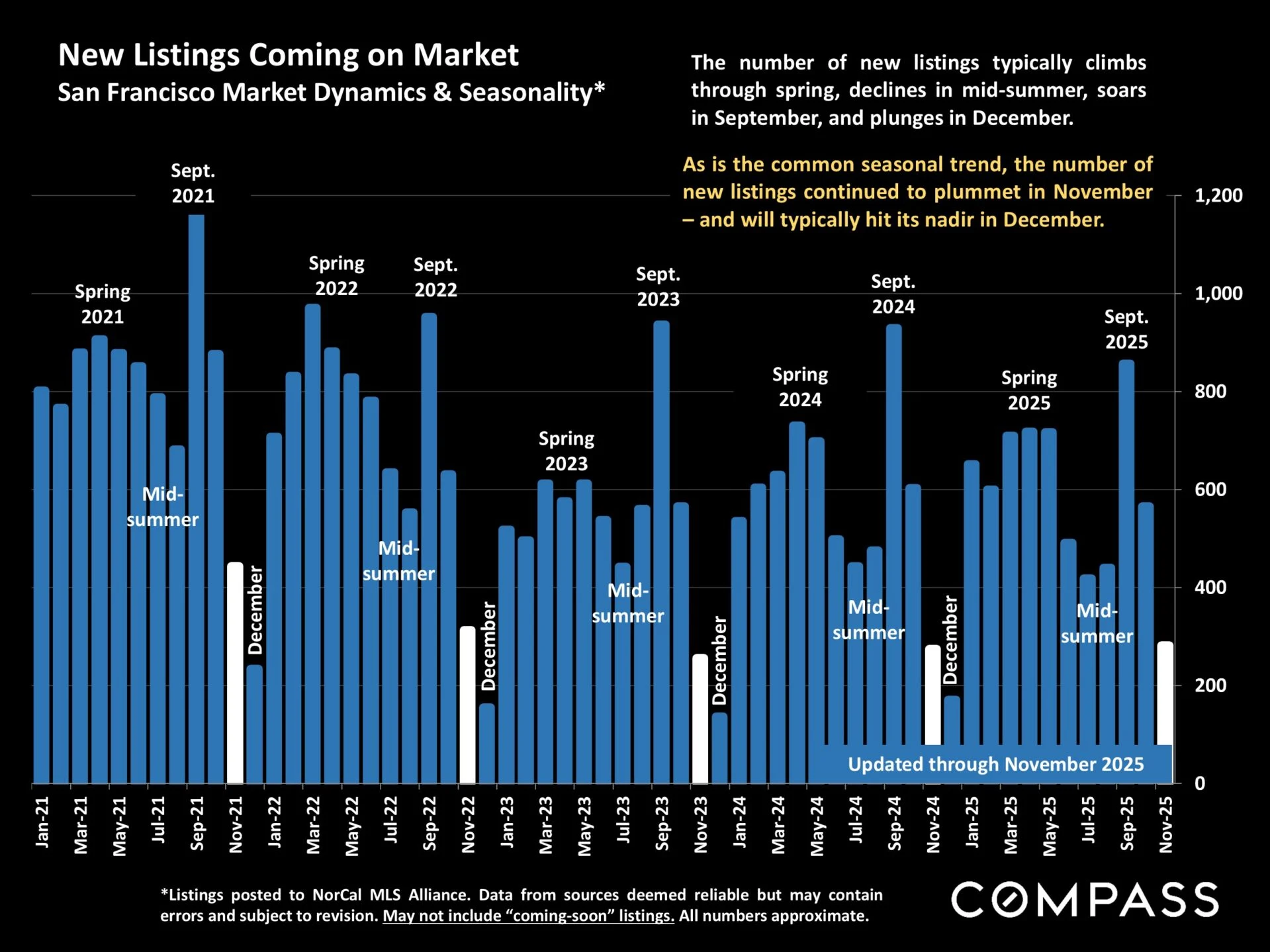

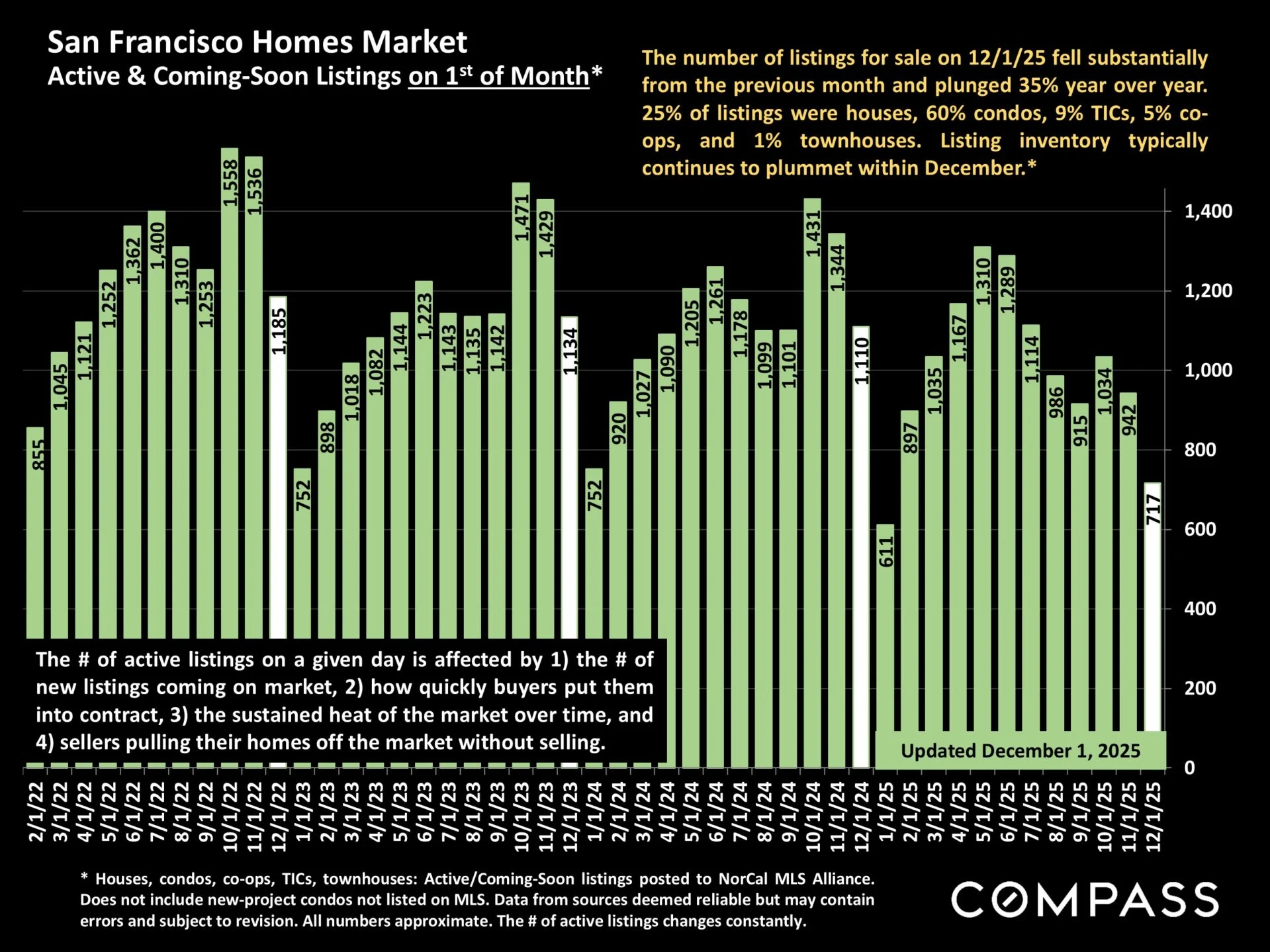

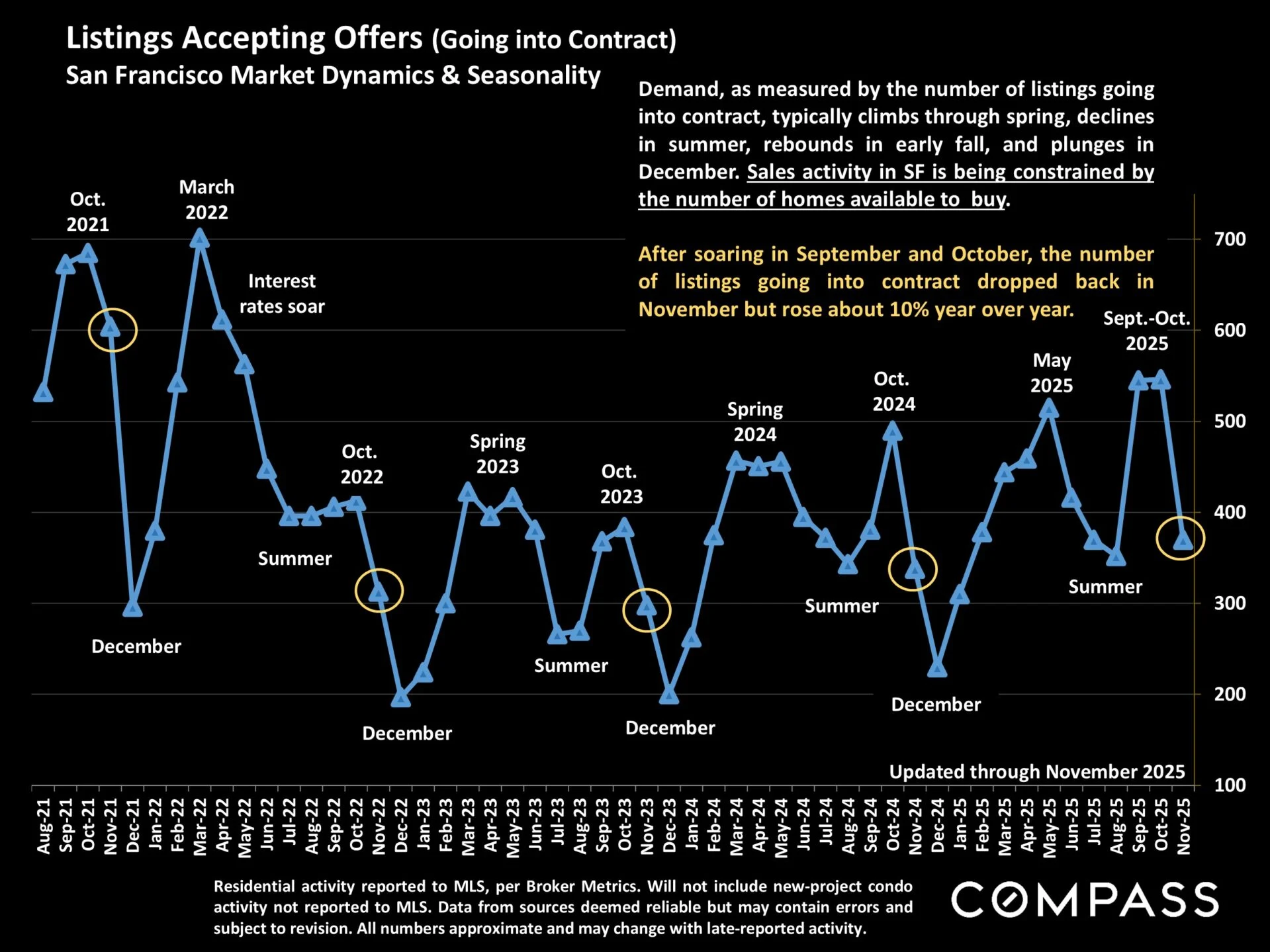

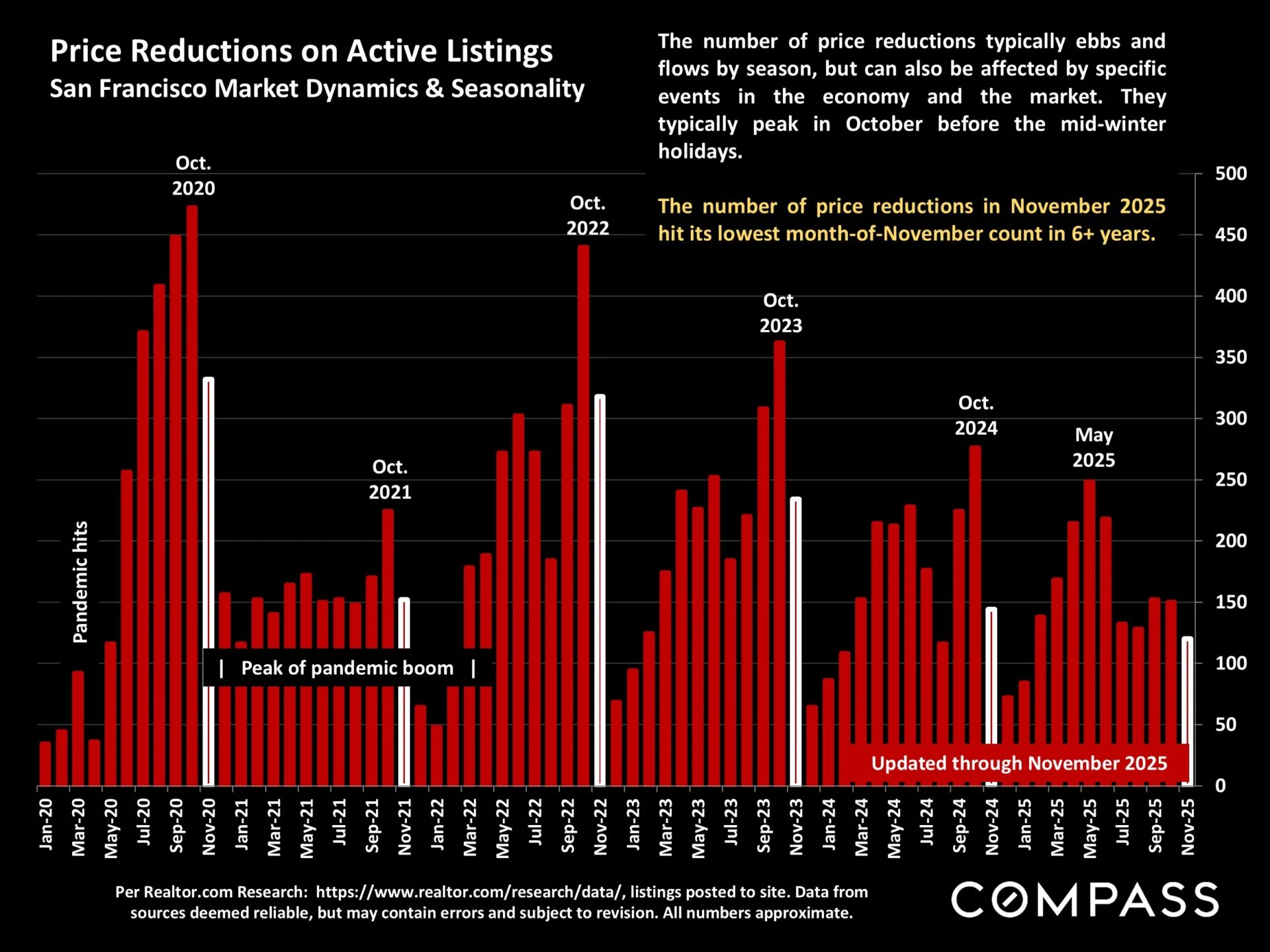

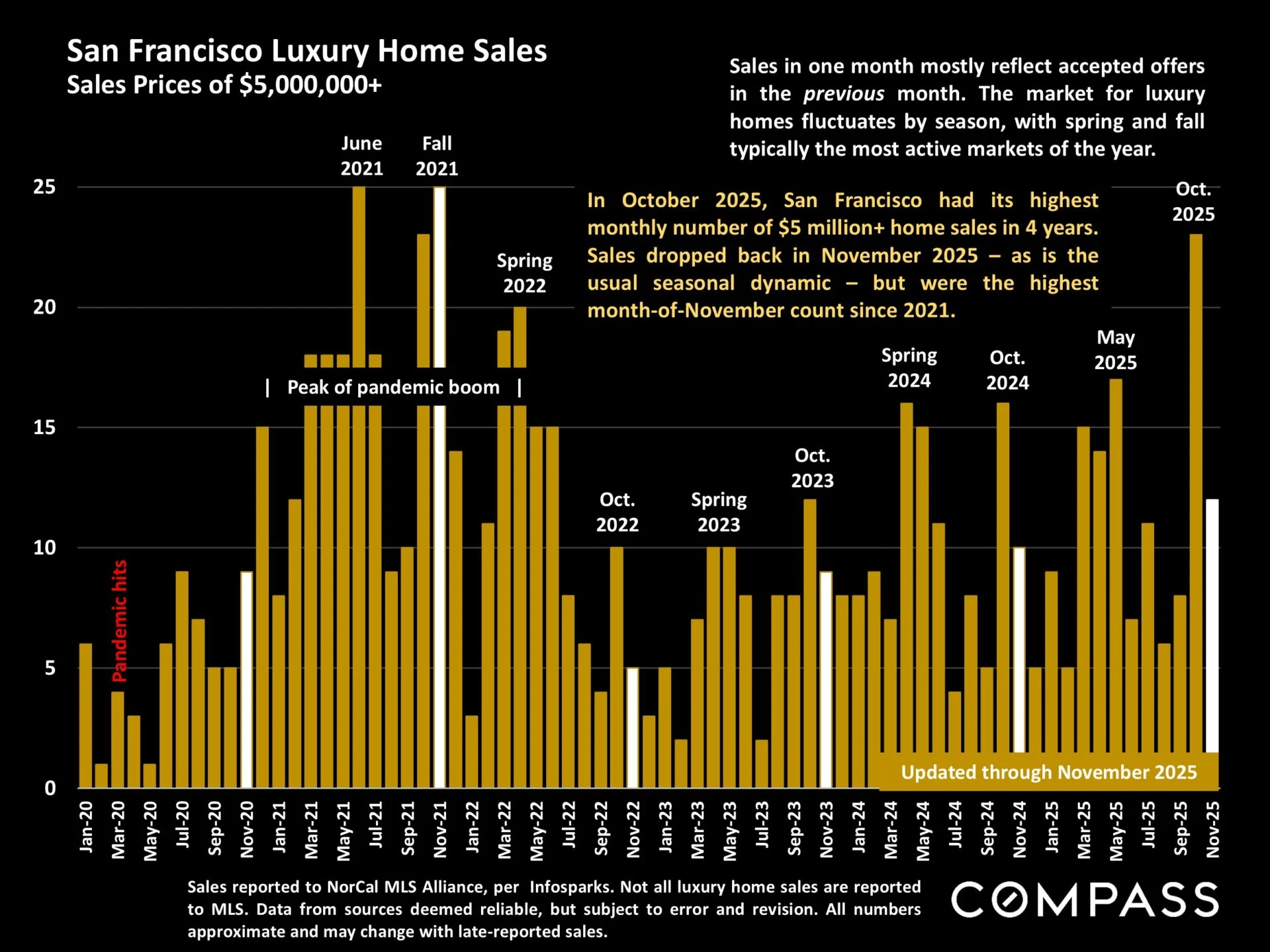

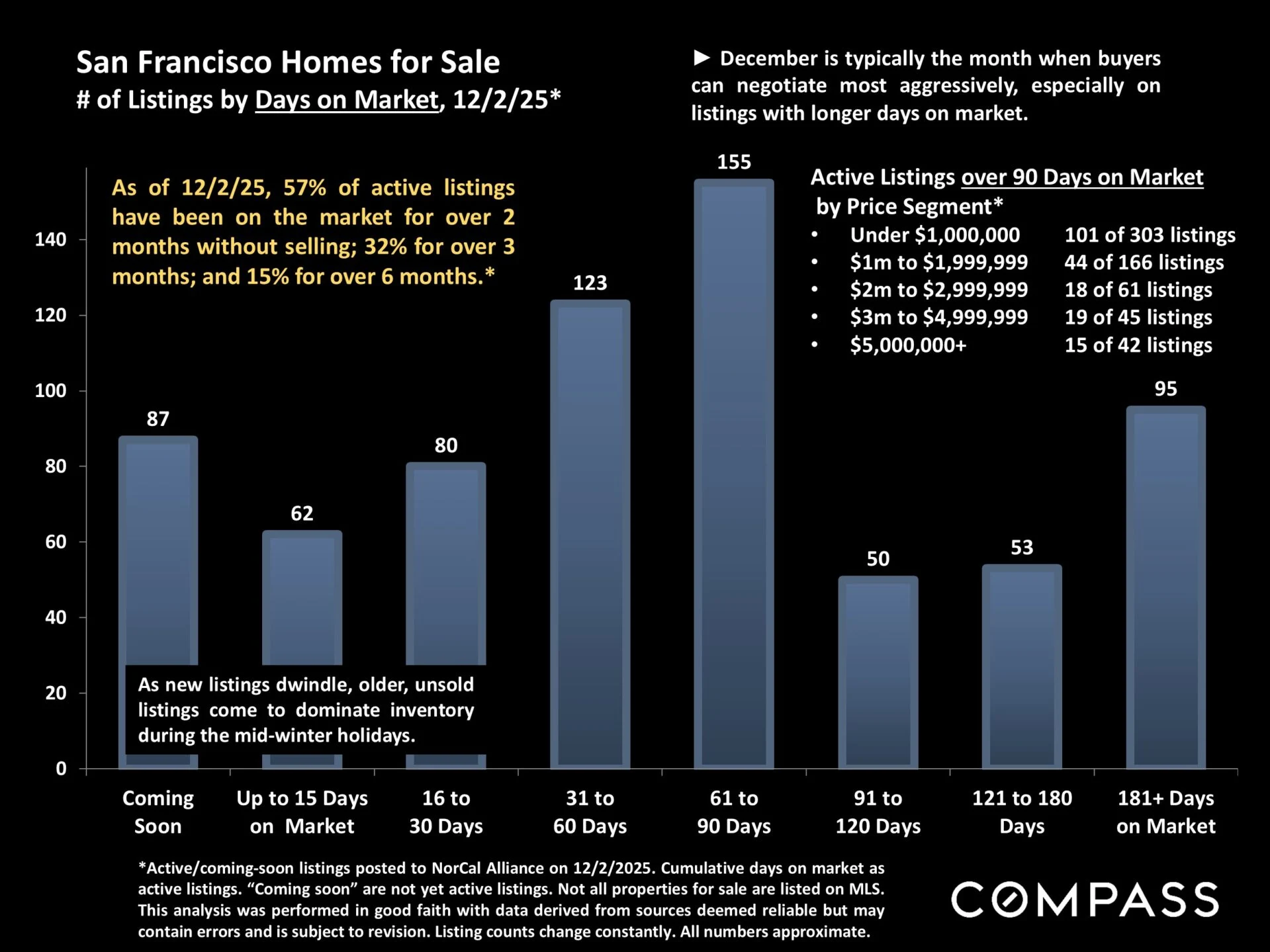

The real estate market began its usual mid-winter holiday season slowdown in November, marked by a substantial decline in both listing and sales activity. This contraction typically speeds up through December – normally the year’s slowest month – before the market begins to wake up in mid-January.

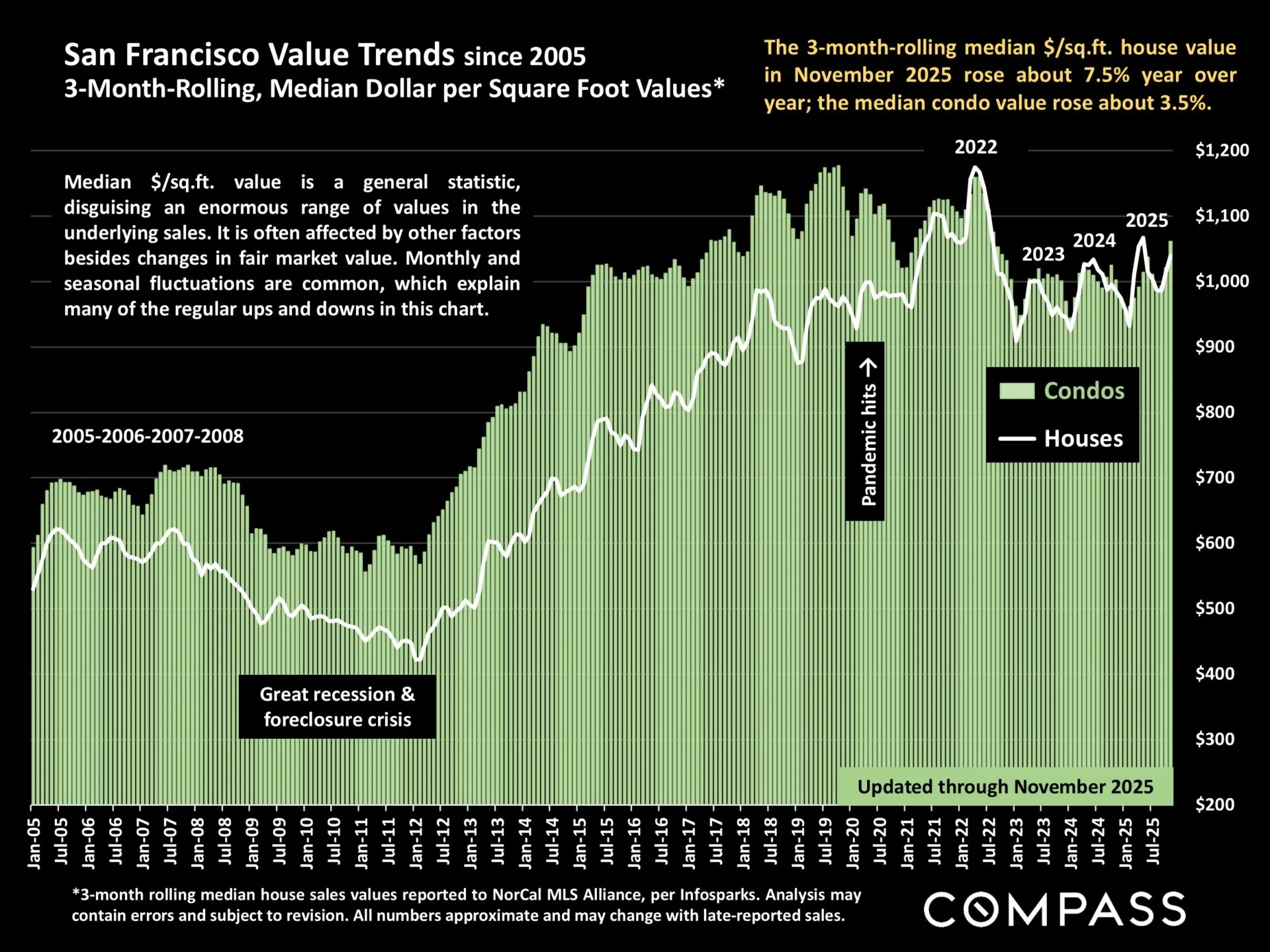

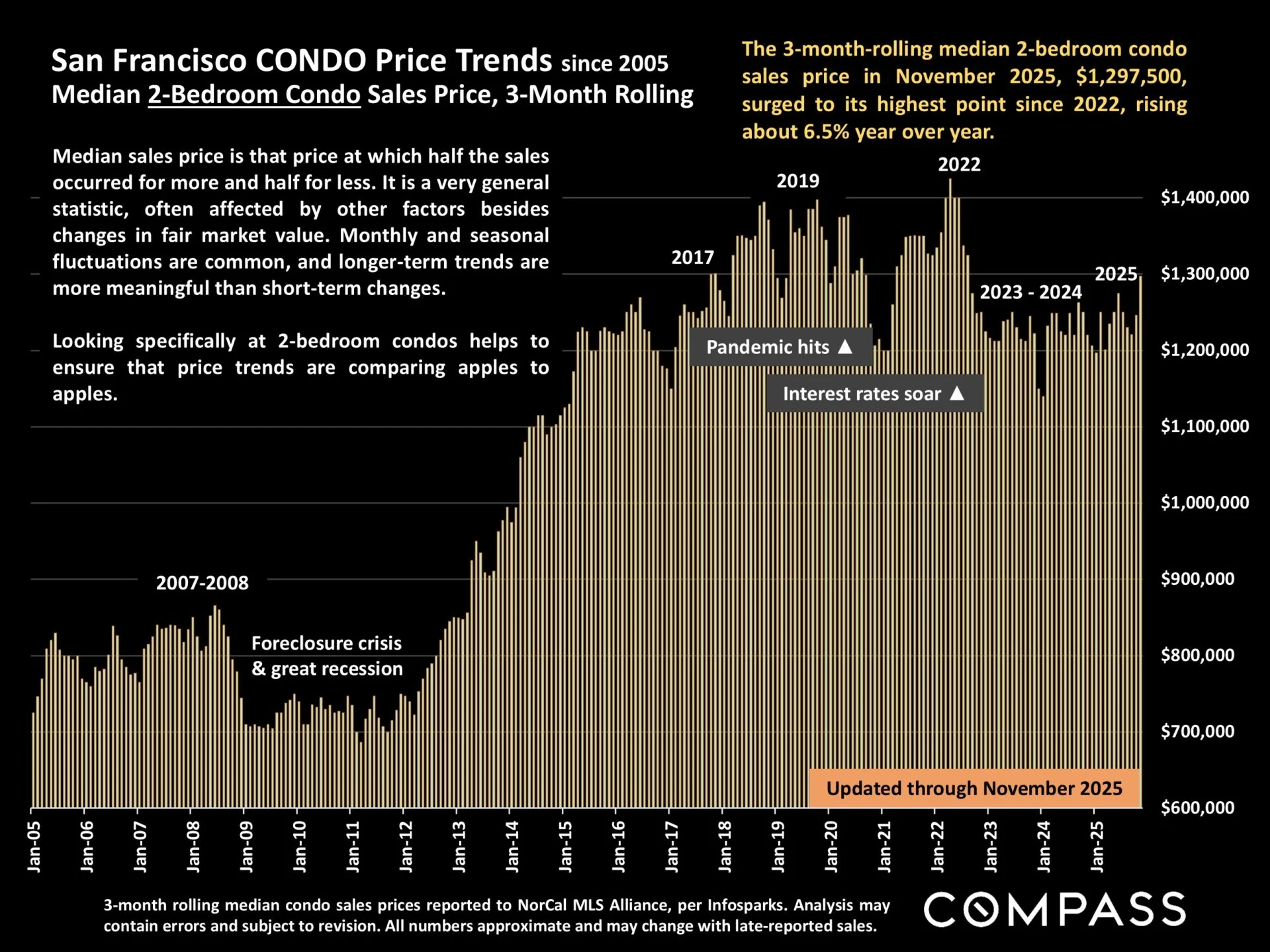

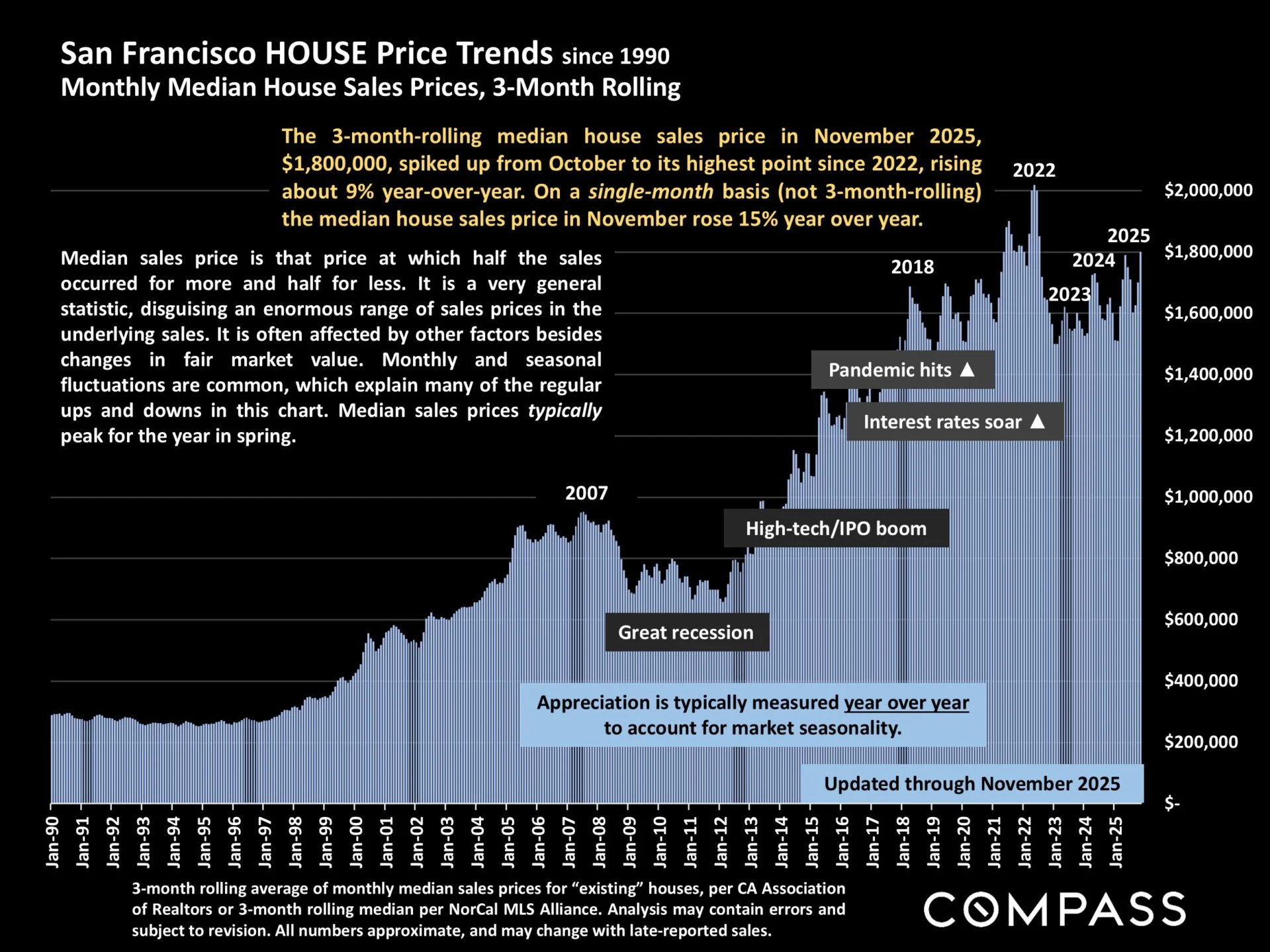

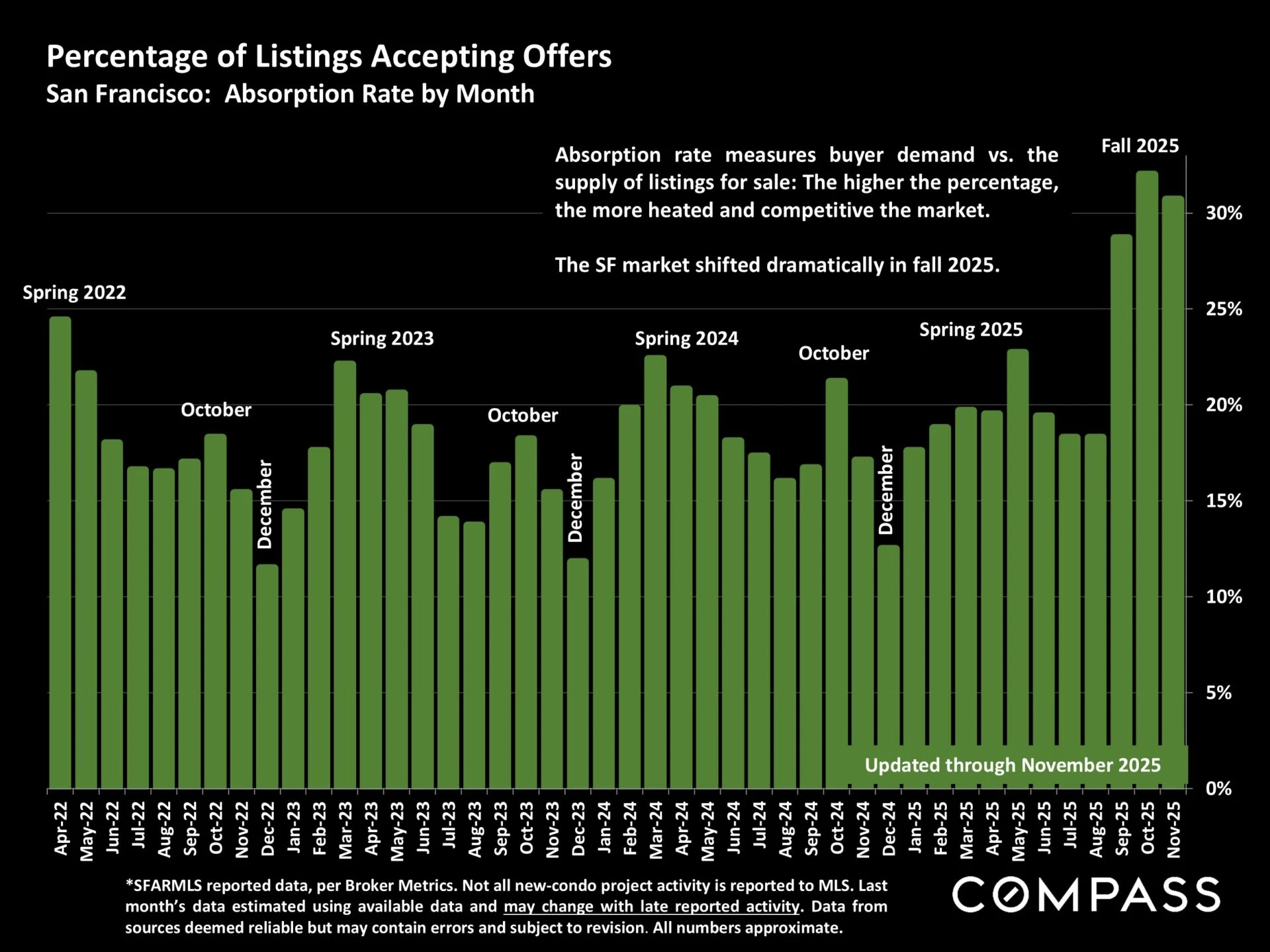

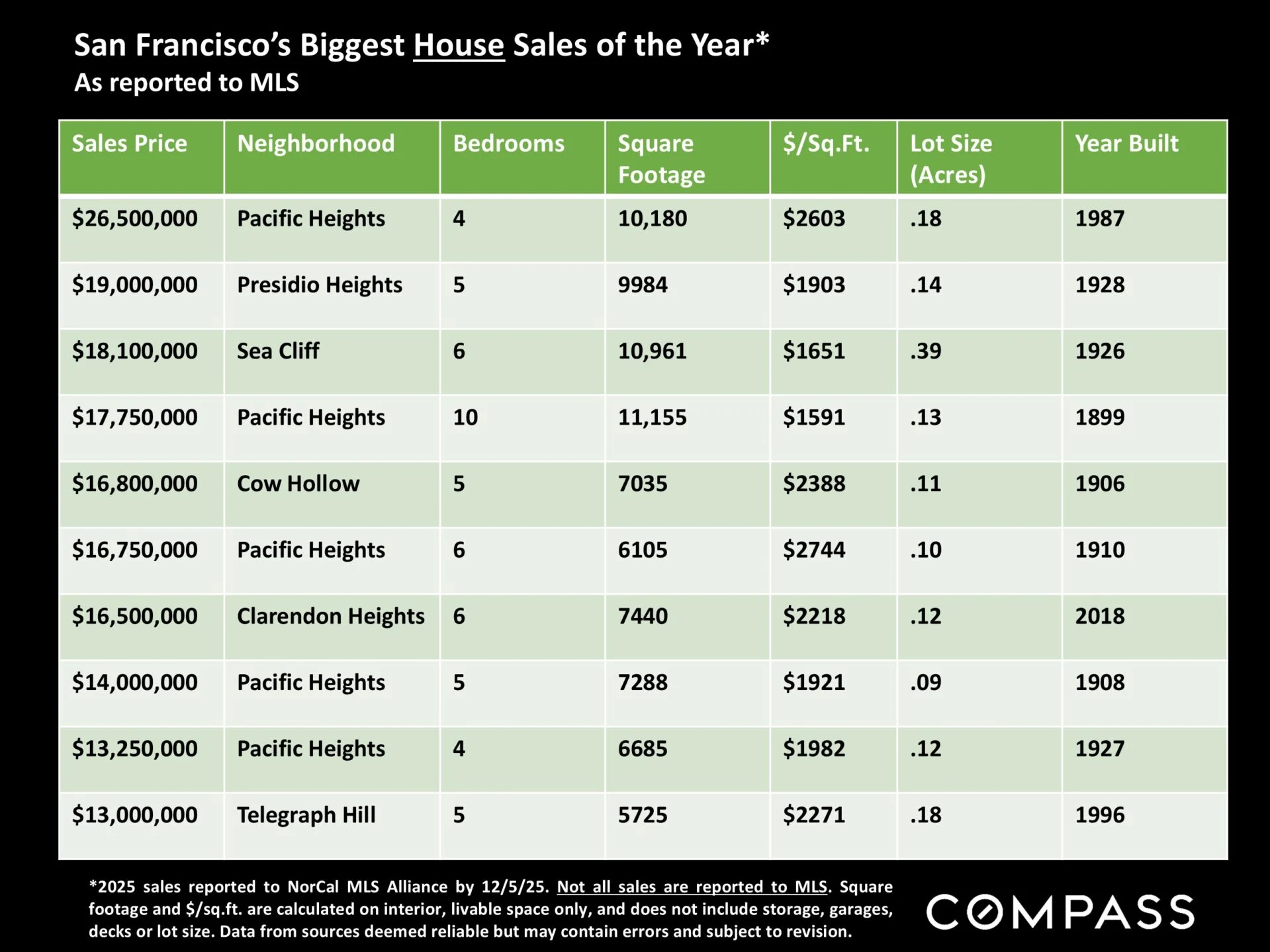

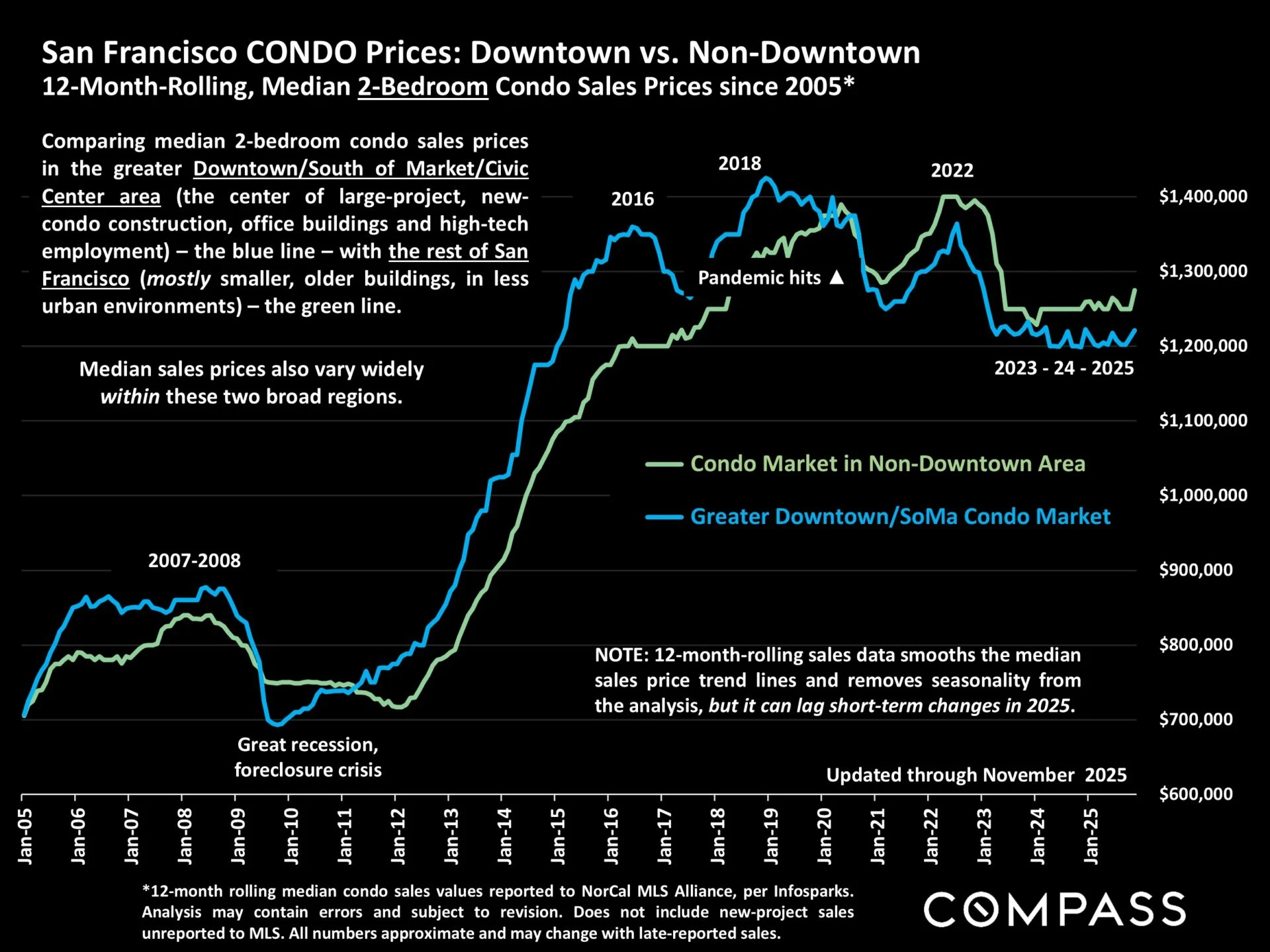

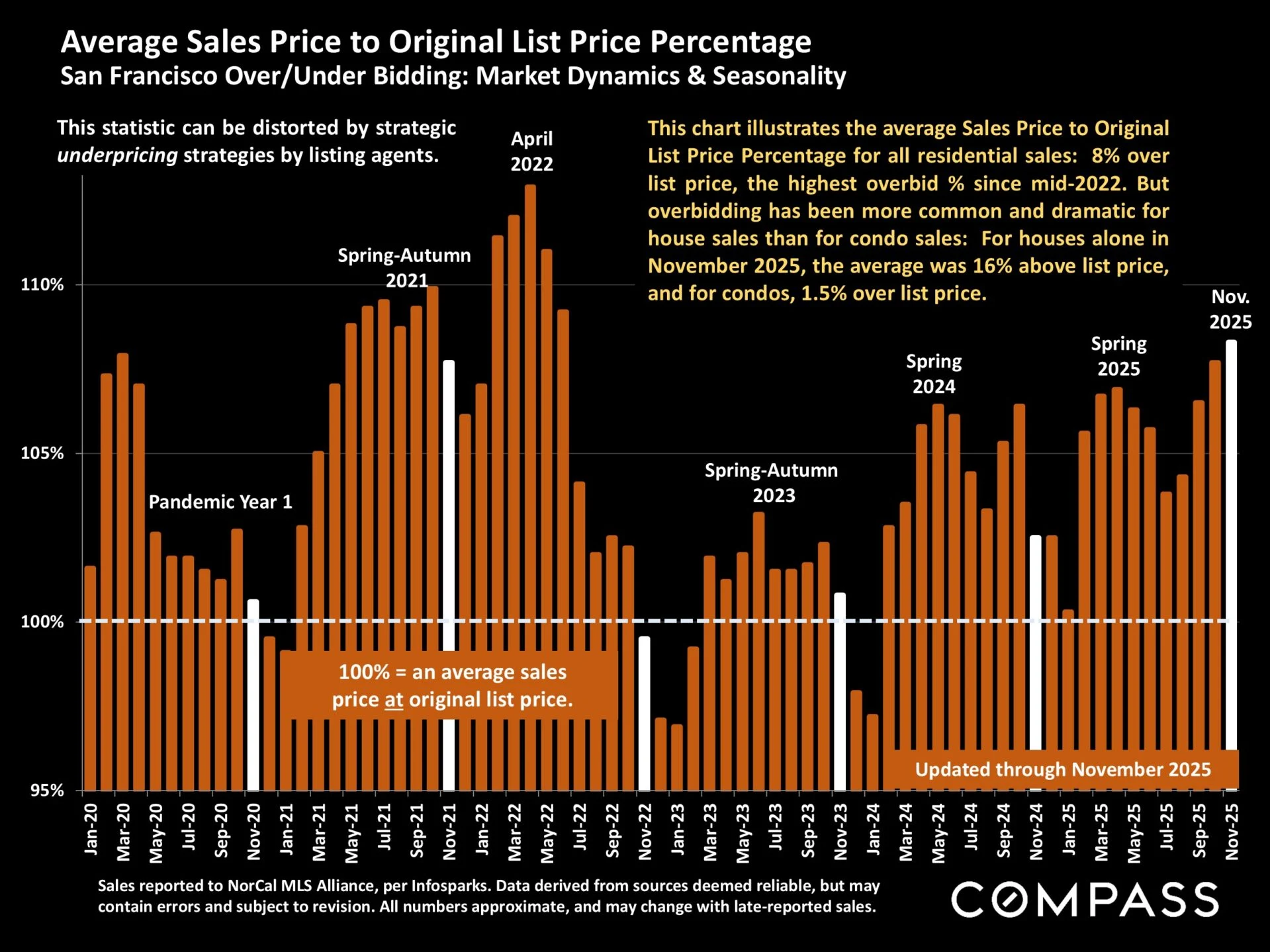

As illustrated within this report, by virtually every indicator – prices, inventory, overbidding, speed of sale – the San Francisco market this past fall saw a stunning surge in demand, which we ascribe to the accelerating AI startup boom in the city. San Francisco now has one of the most heated markets in the country.

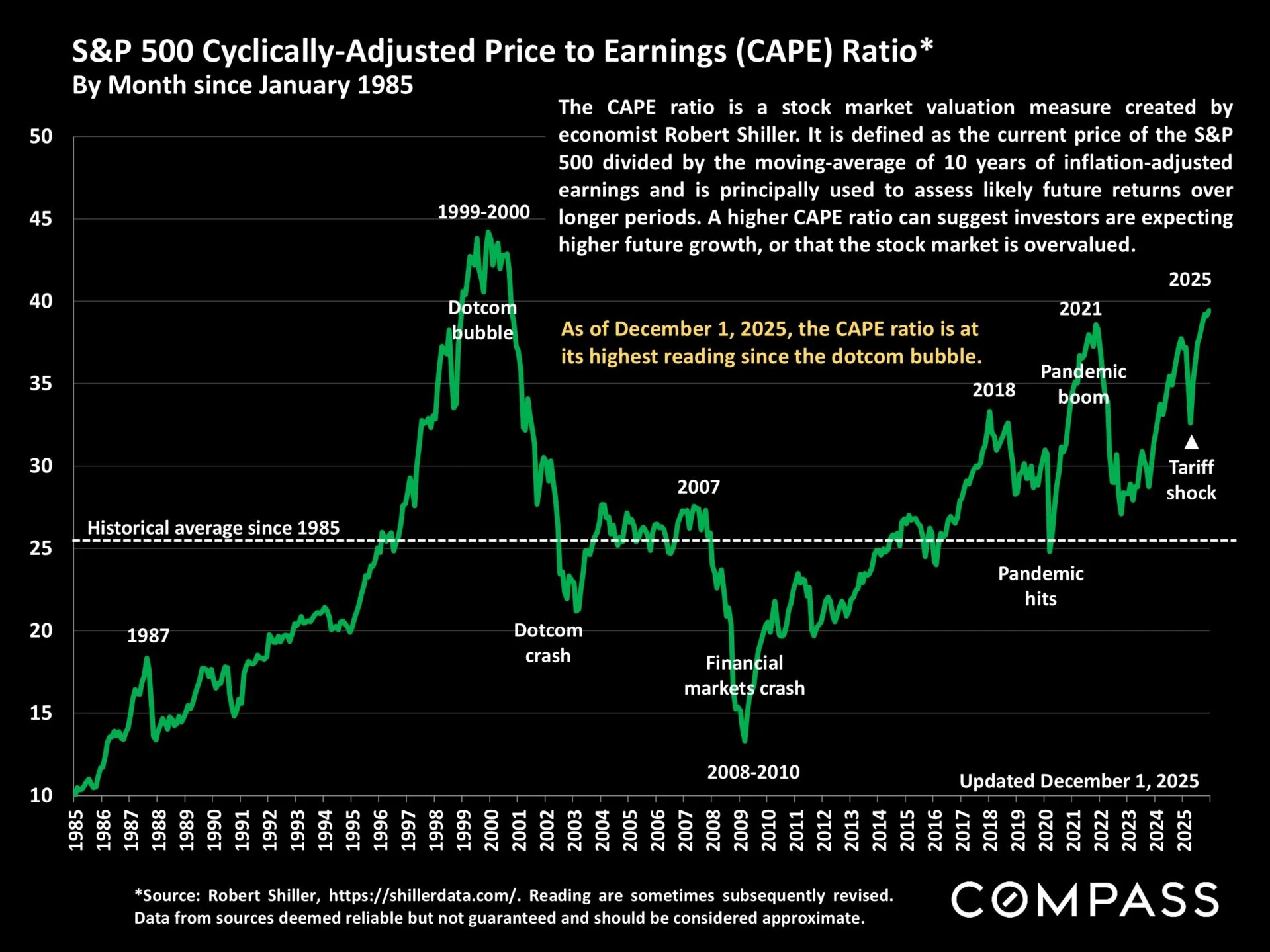

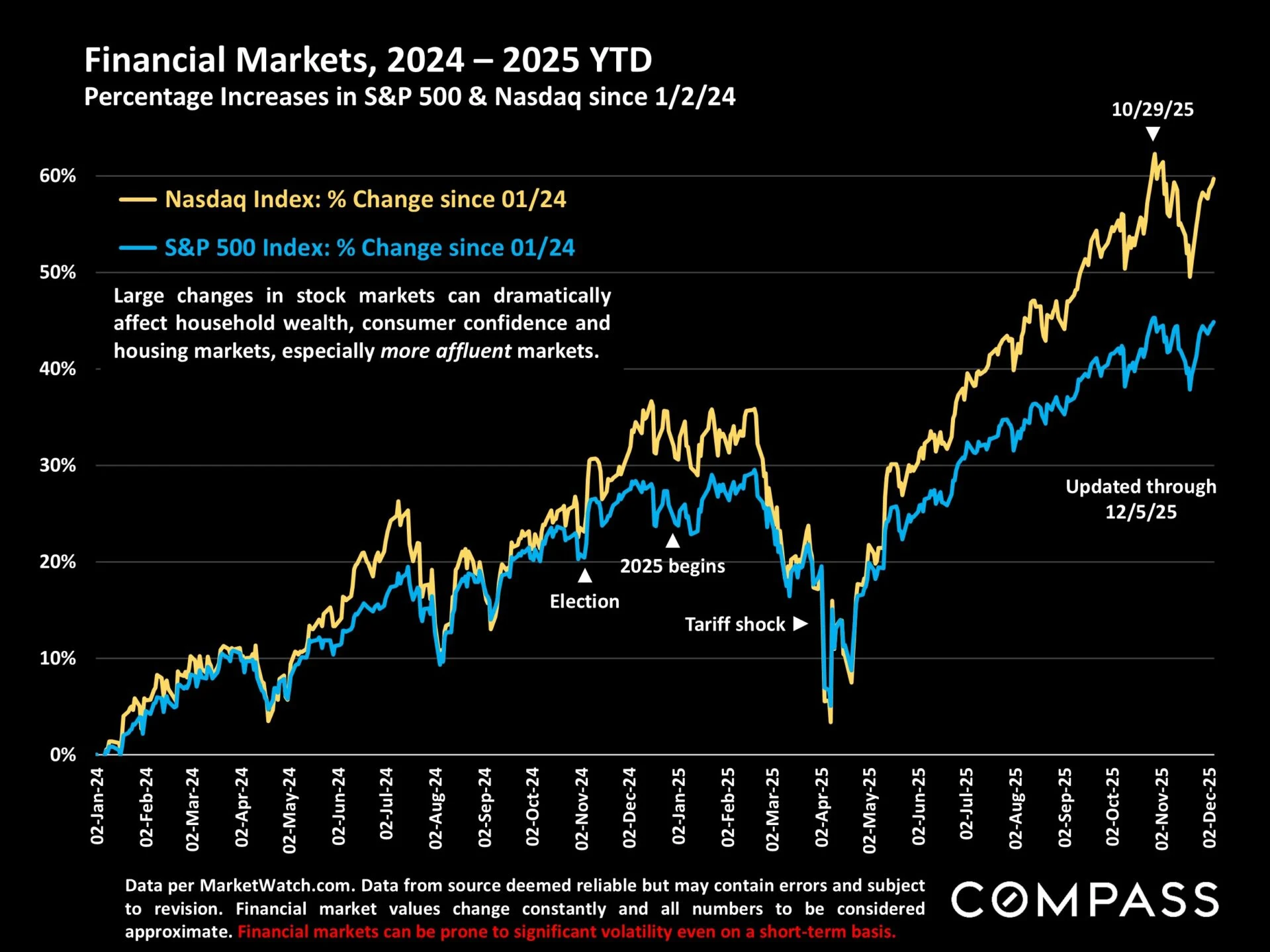

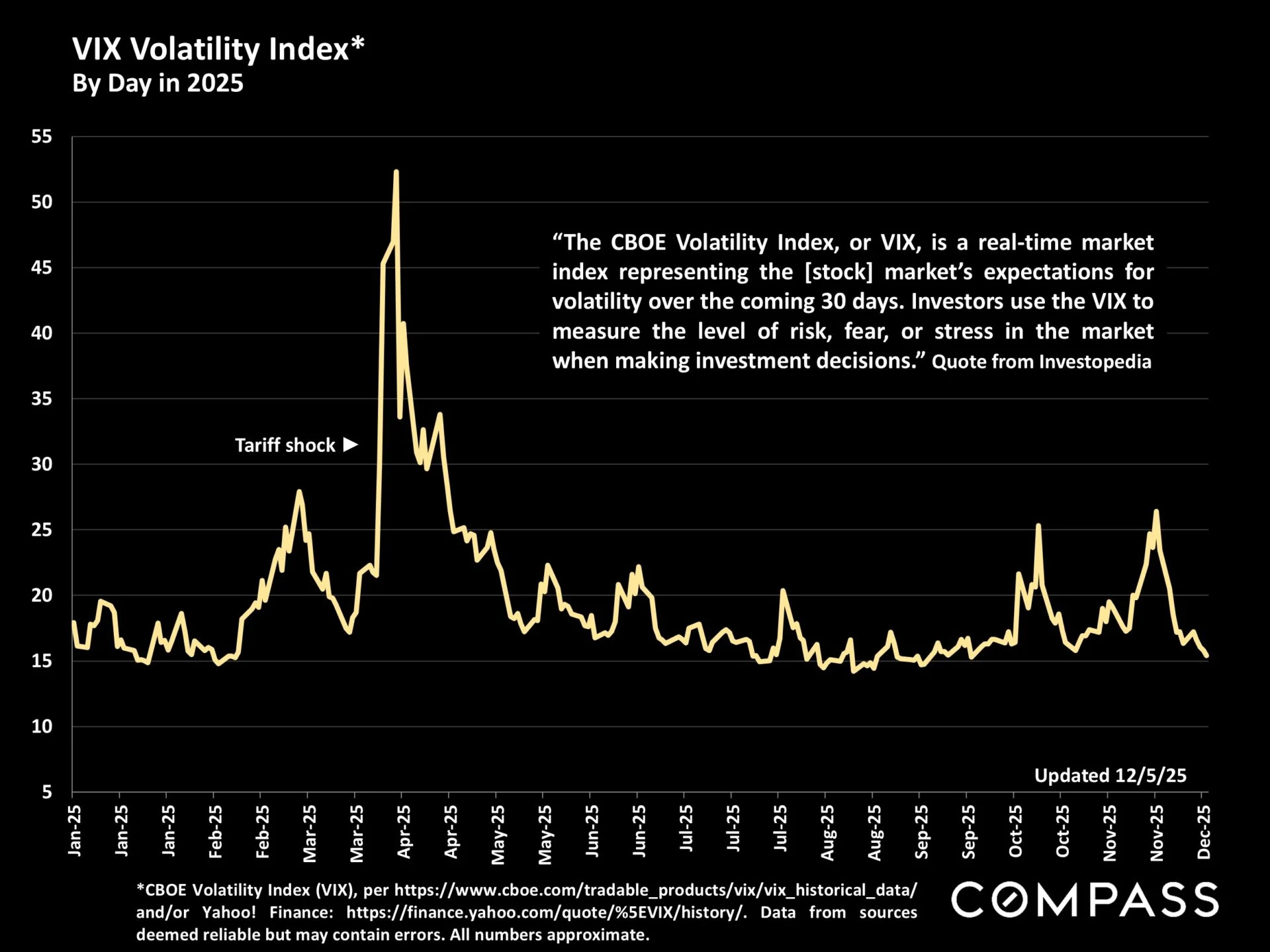

Our focus now shifts toward the New Year’s market. In the past, the beginning of the year frequently ushered in a substantially higher level of activity that continued to build into spring. This occurred in early 2025 until affected by the “tariff shock” and subsequent economic reactions, initiating a significant slowdown in April.

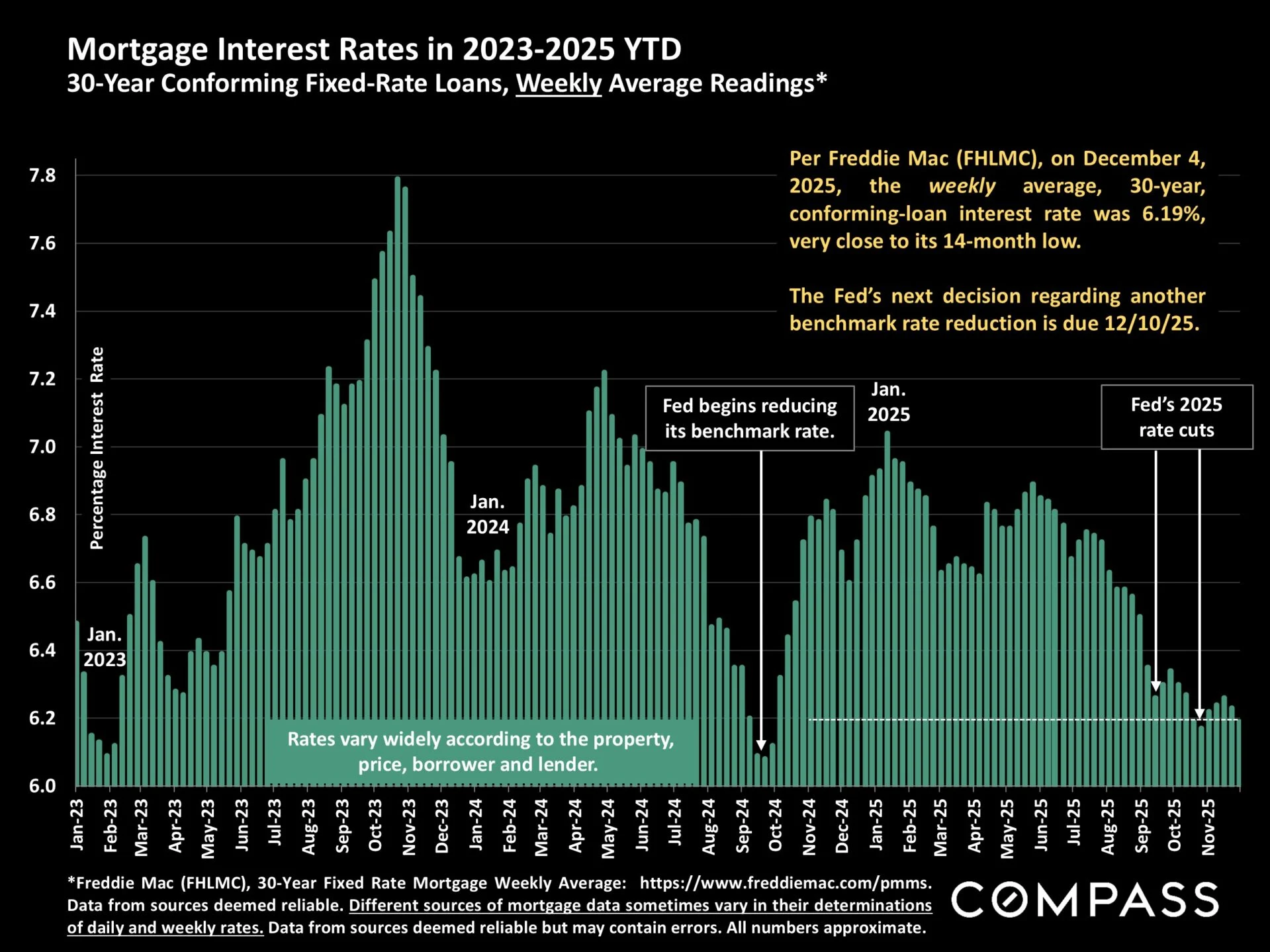

In the broader financial landscape, the first week of December saw the S&P 500 and Nasdaq largely recover from their substantial declines in November; and the 30-year mortgage rate was close to a 14-month low. While consumer confidence showed a modest rise from November, it remains very low by long-term standards – but this does not seem to be impacting the SF market. Attention is now focused on the Federal Reserve’s upcoming decision regarding an end-of-year benchmark-rate reduction, and the subsequent inflation report due later in the month.

Report created in good faith using data from sources deemed reliable but may contain errors and subject to revision. Last period figures are preliminary estimates based on data available early in the following month. All numbers approximate and may change with late-reported activity.