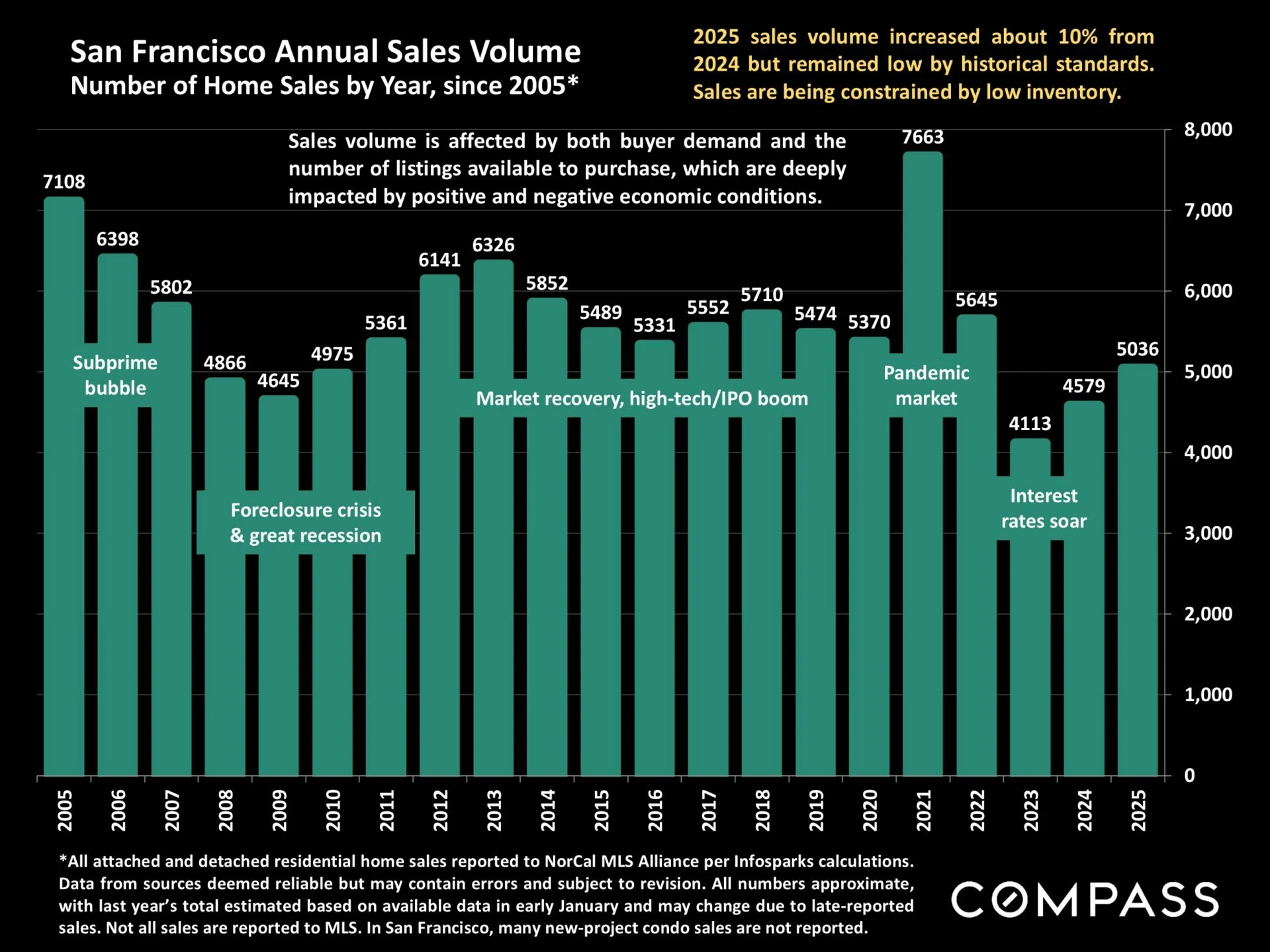

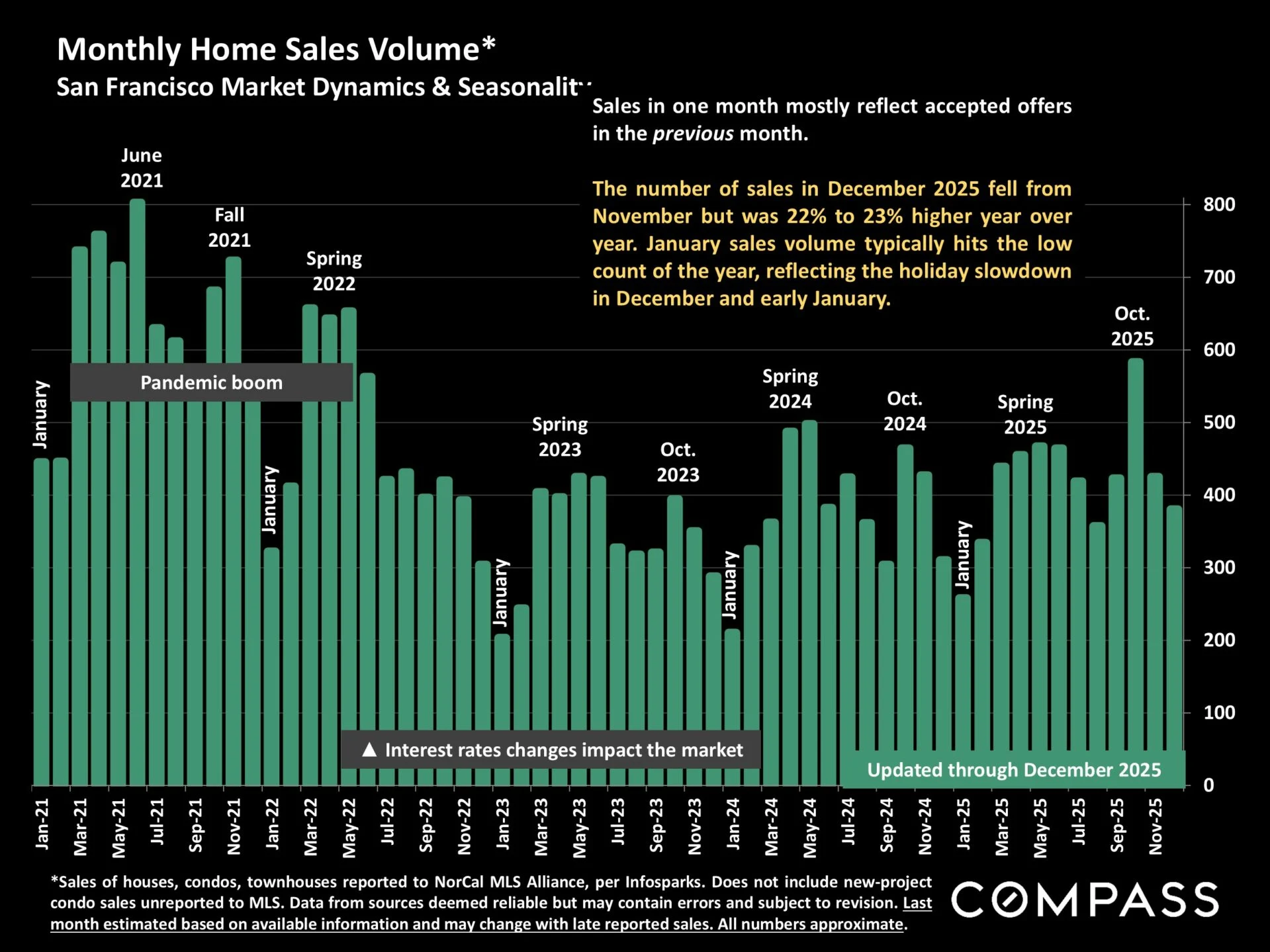

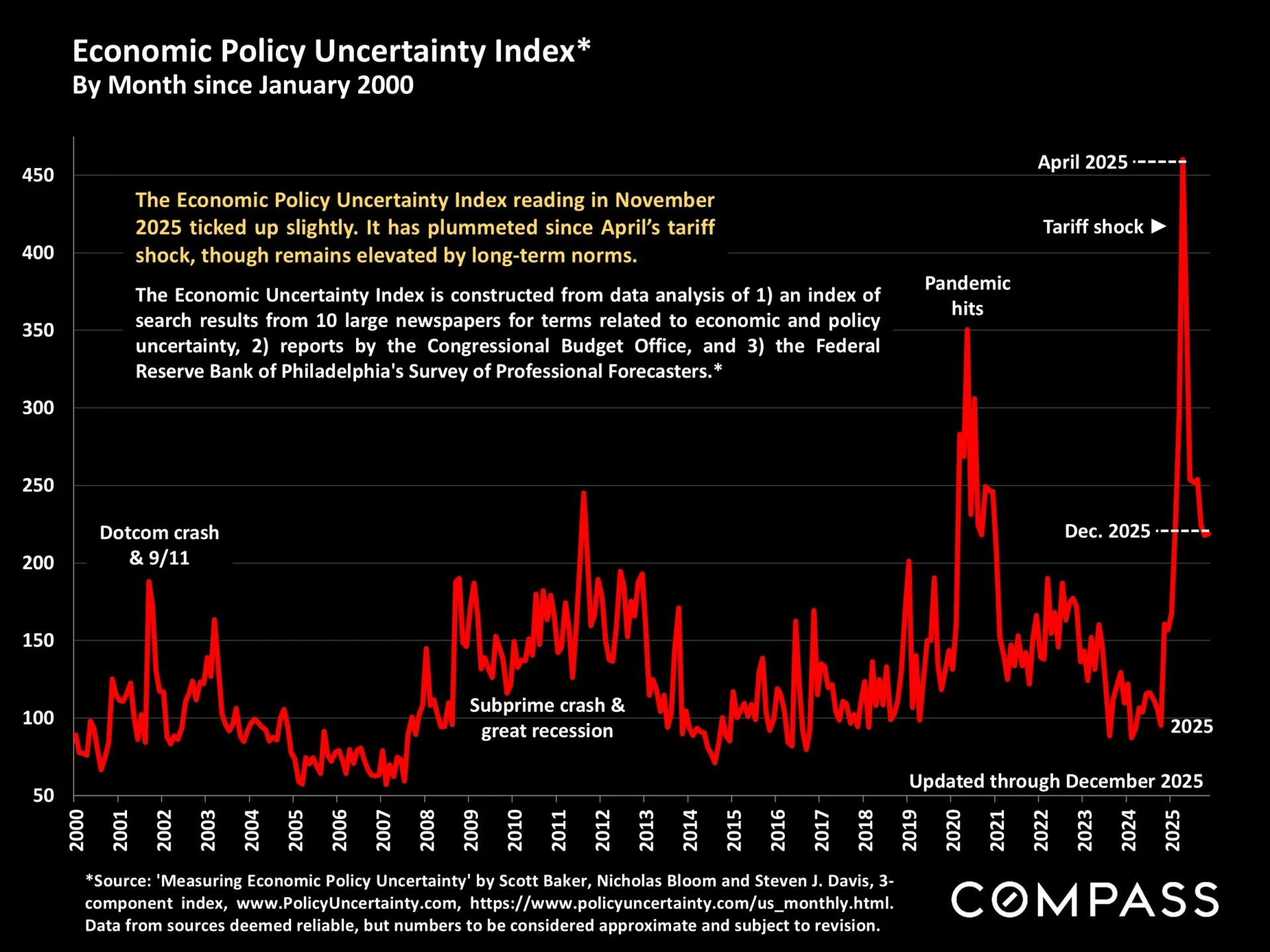

I wanted to kick off 2026 by sharing our annual market report — because the start of this year is already feeling very different from anything I’ve seen in a while.

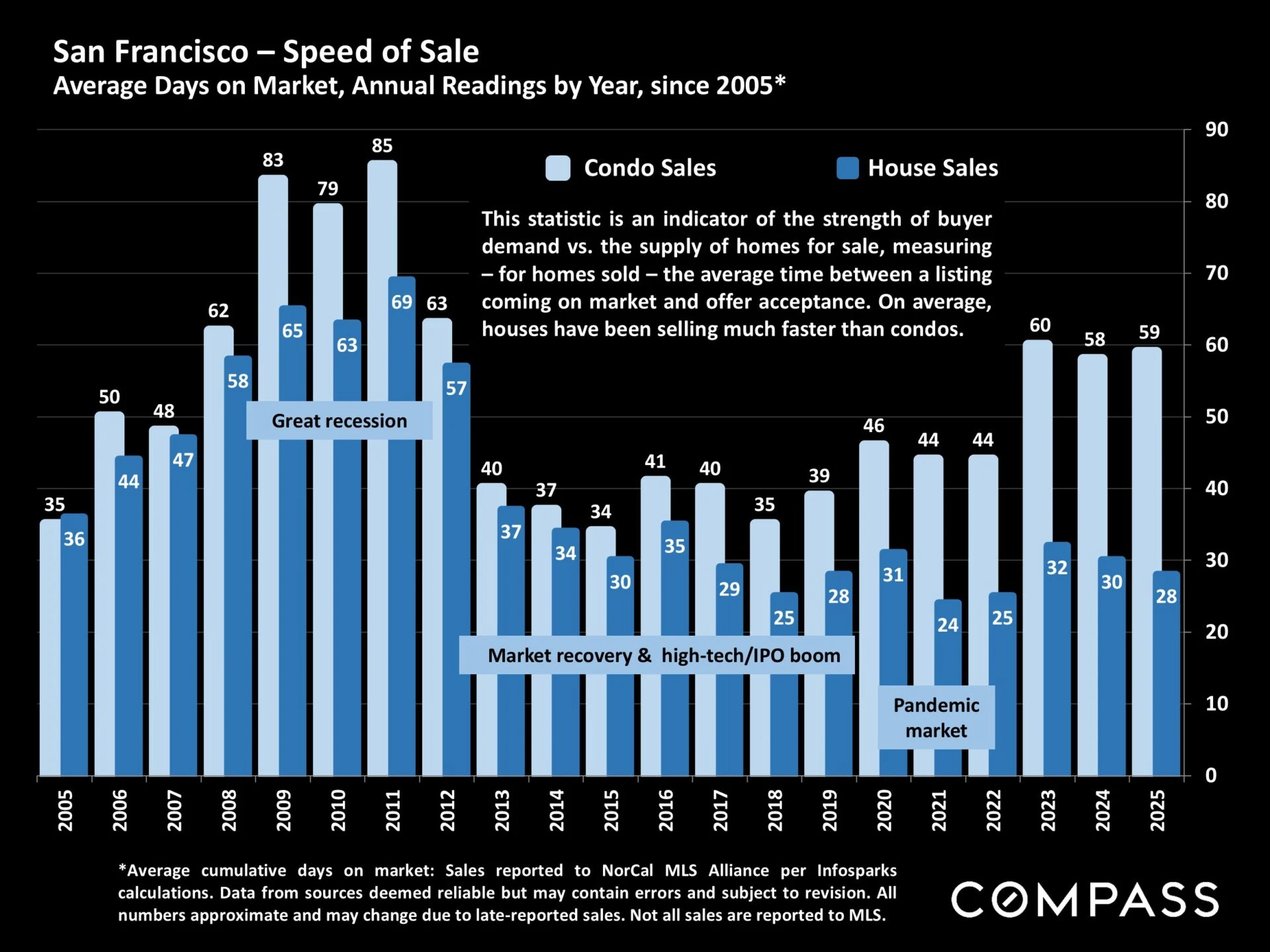

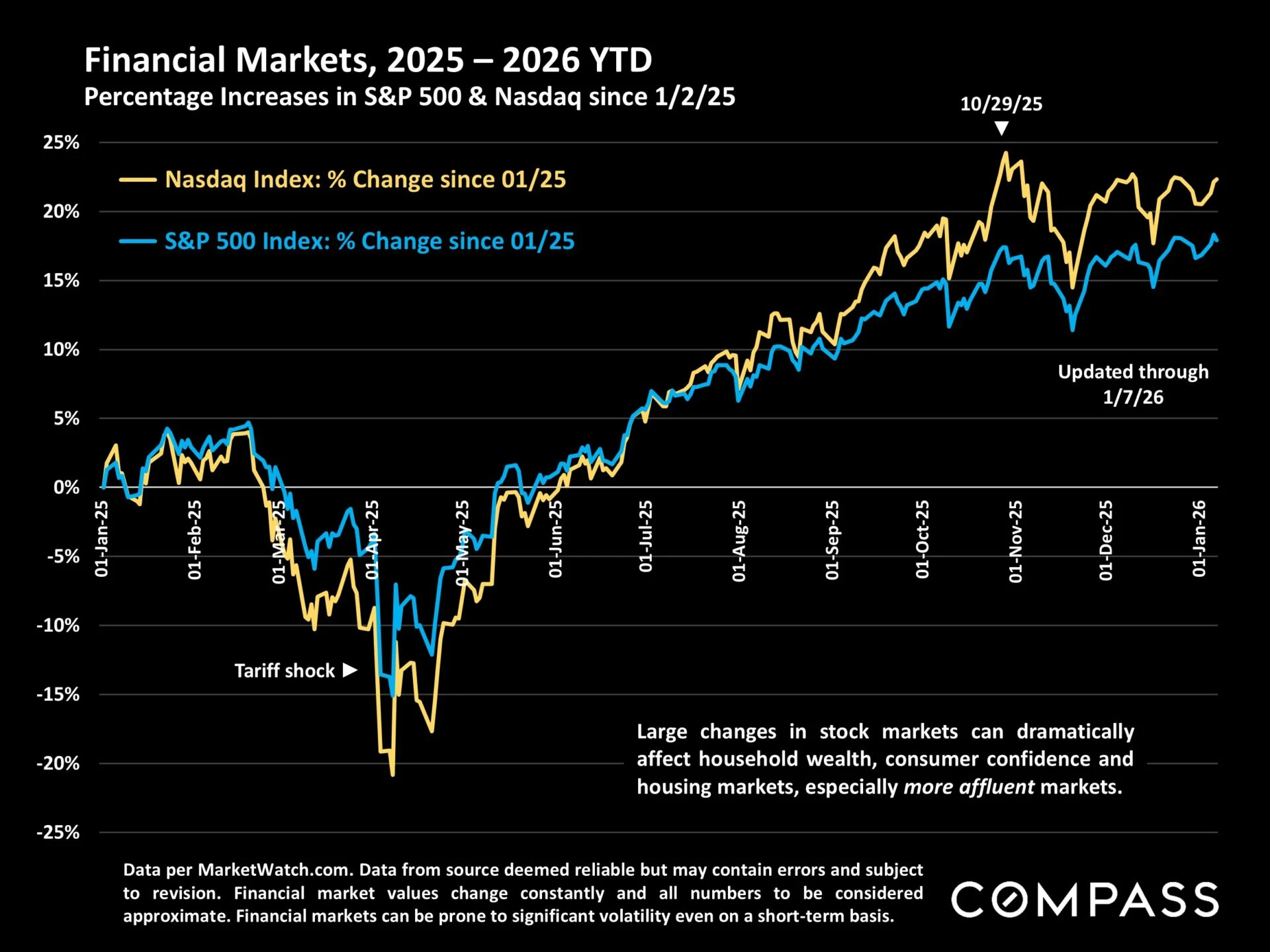

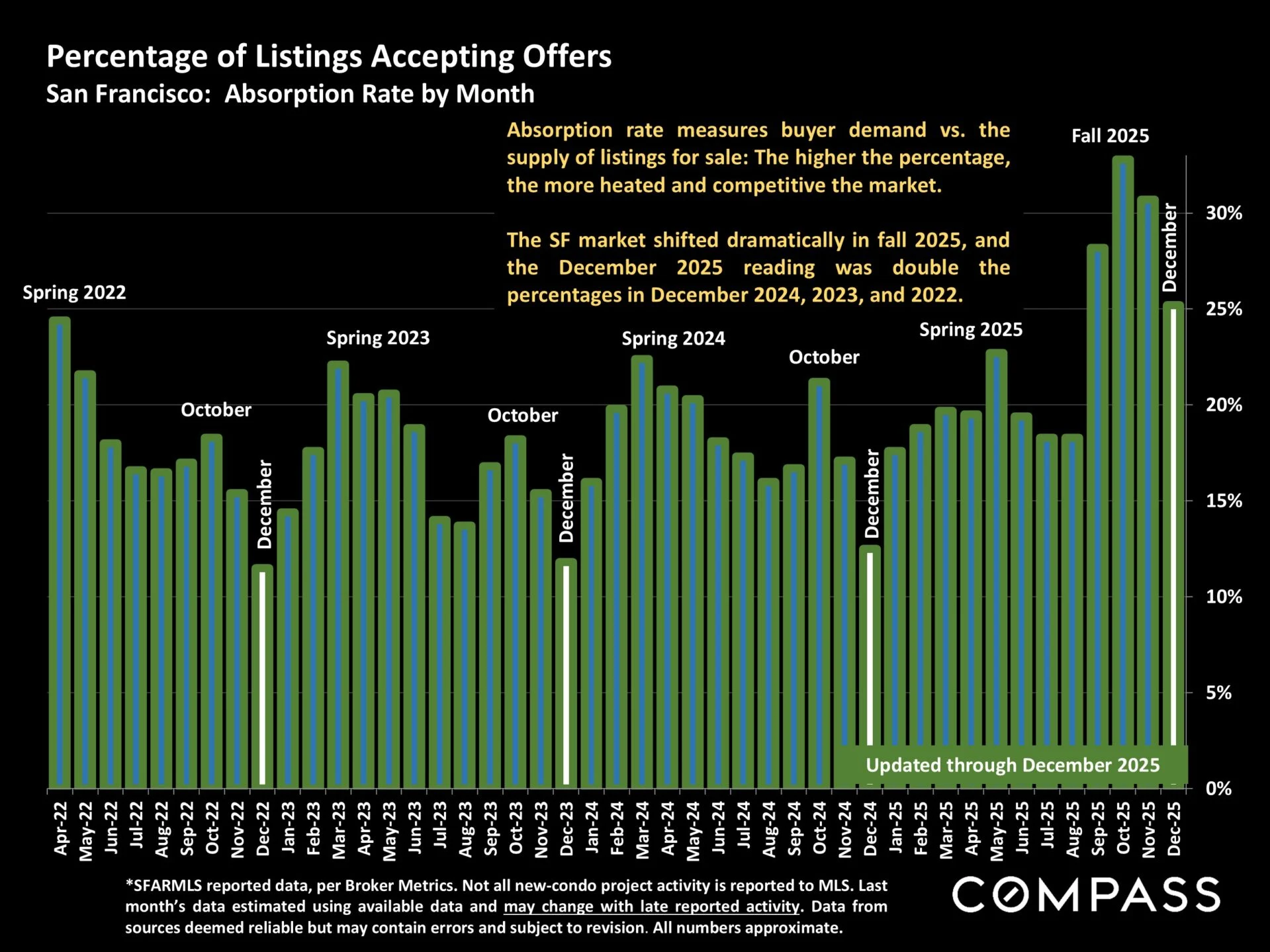

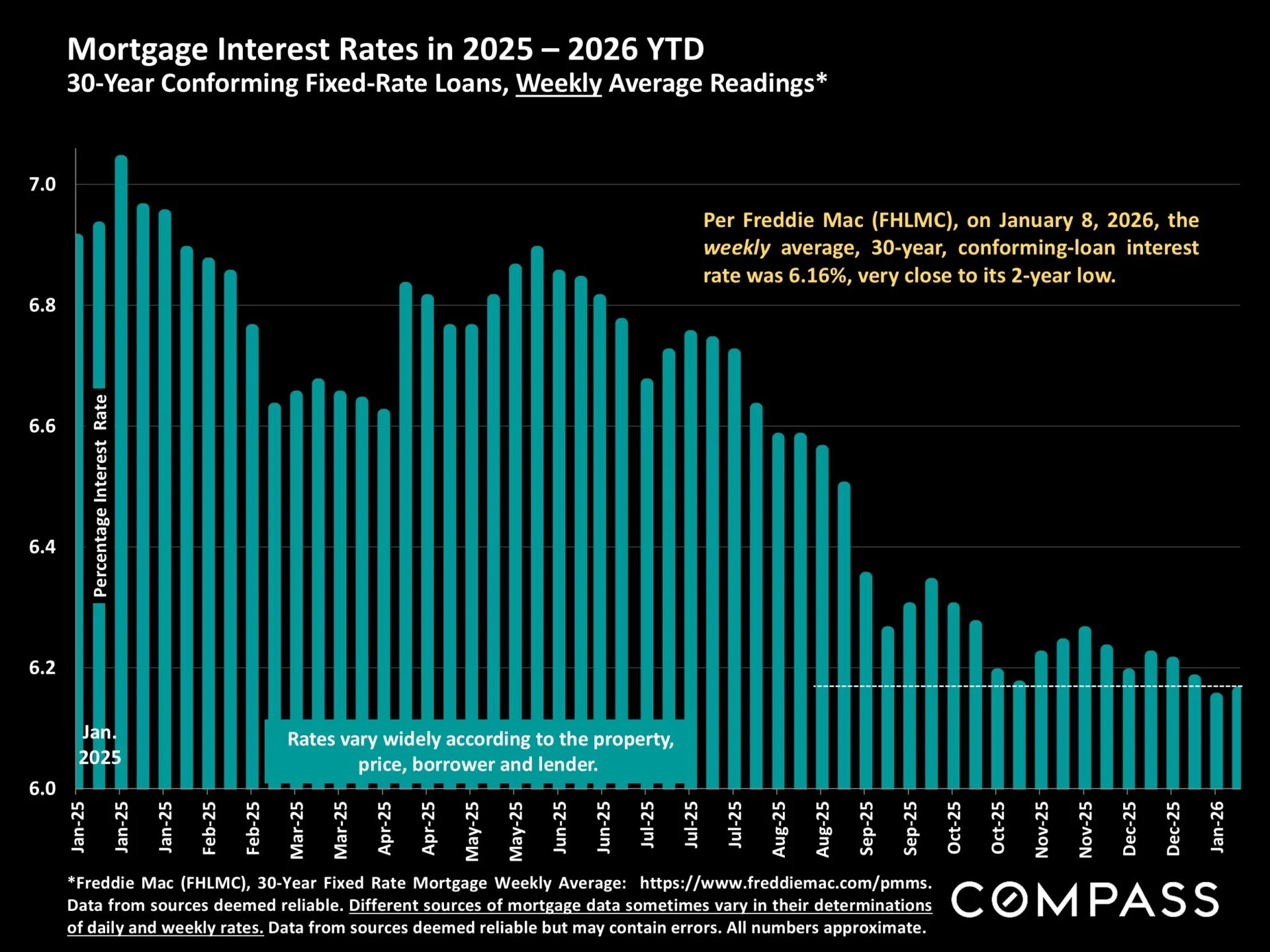

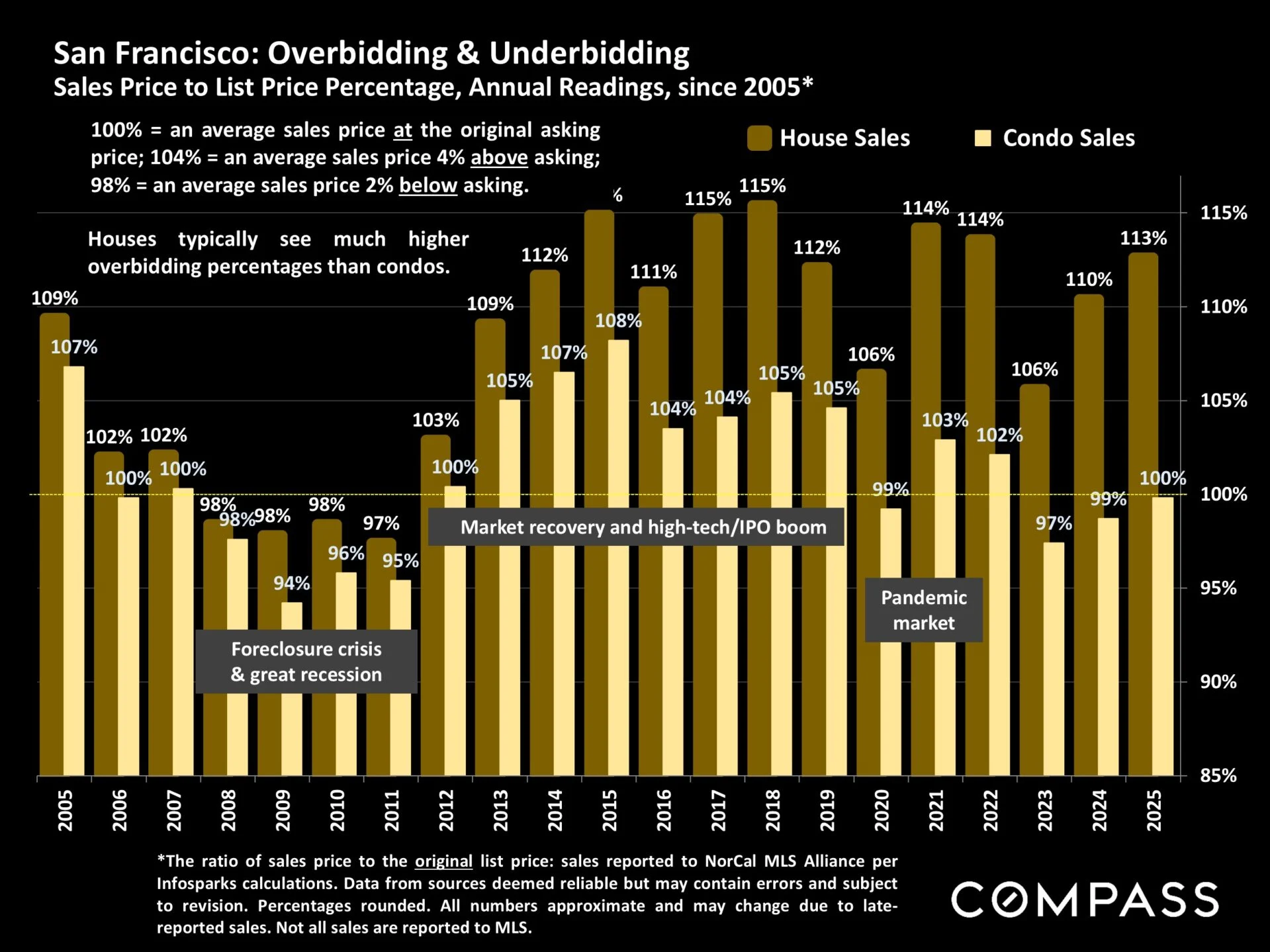

We’re starting the year with what feels like a perfect storm: interest rates coming down, the stock market near all-time highs, and a level of buyer motivation I honestly haven’t seen in a long time.

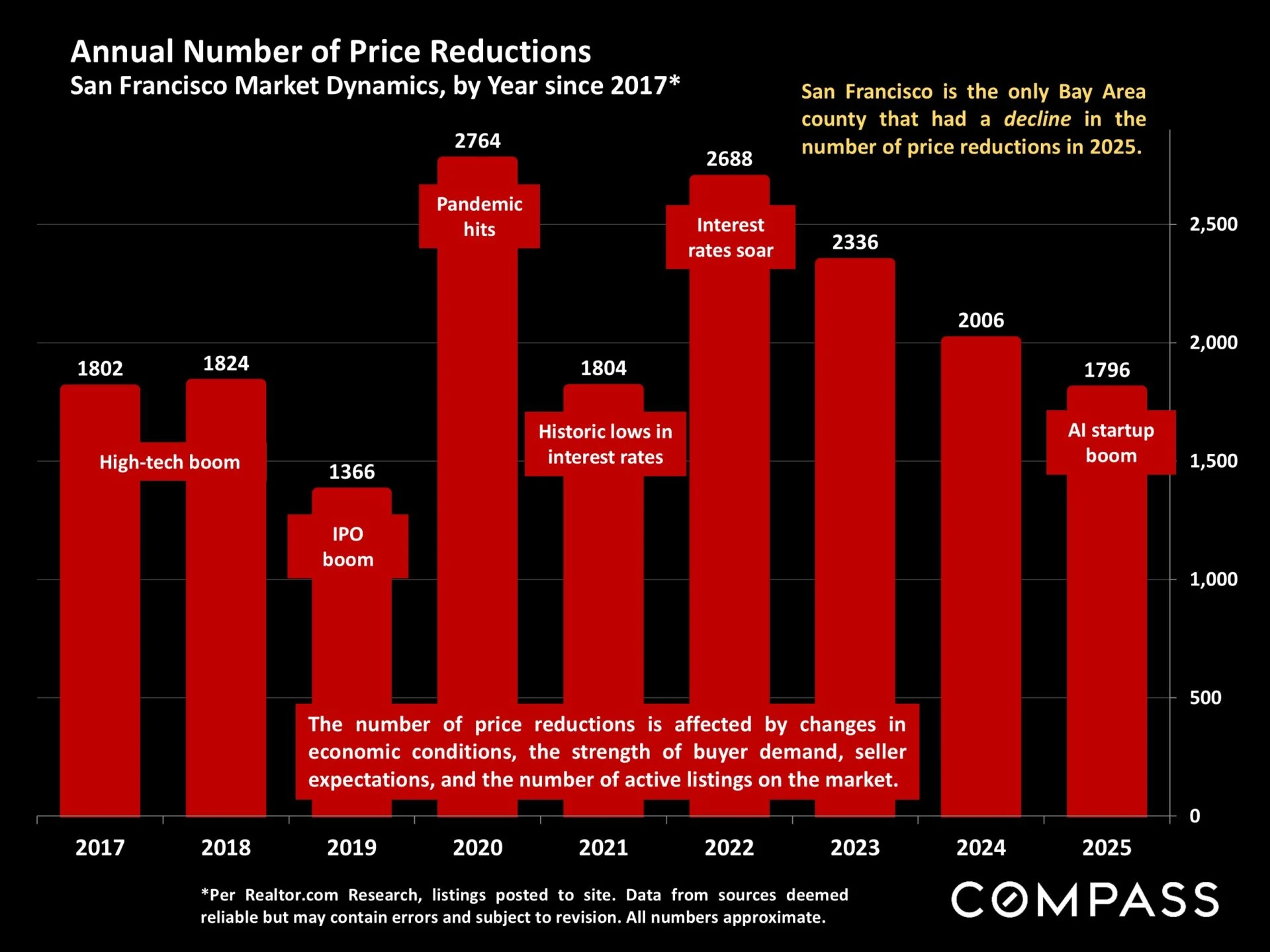

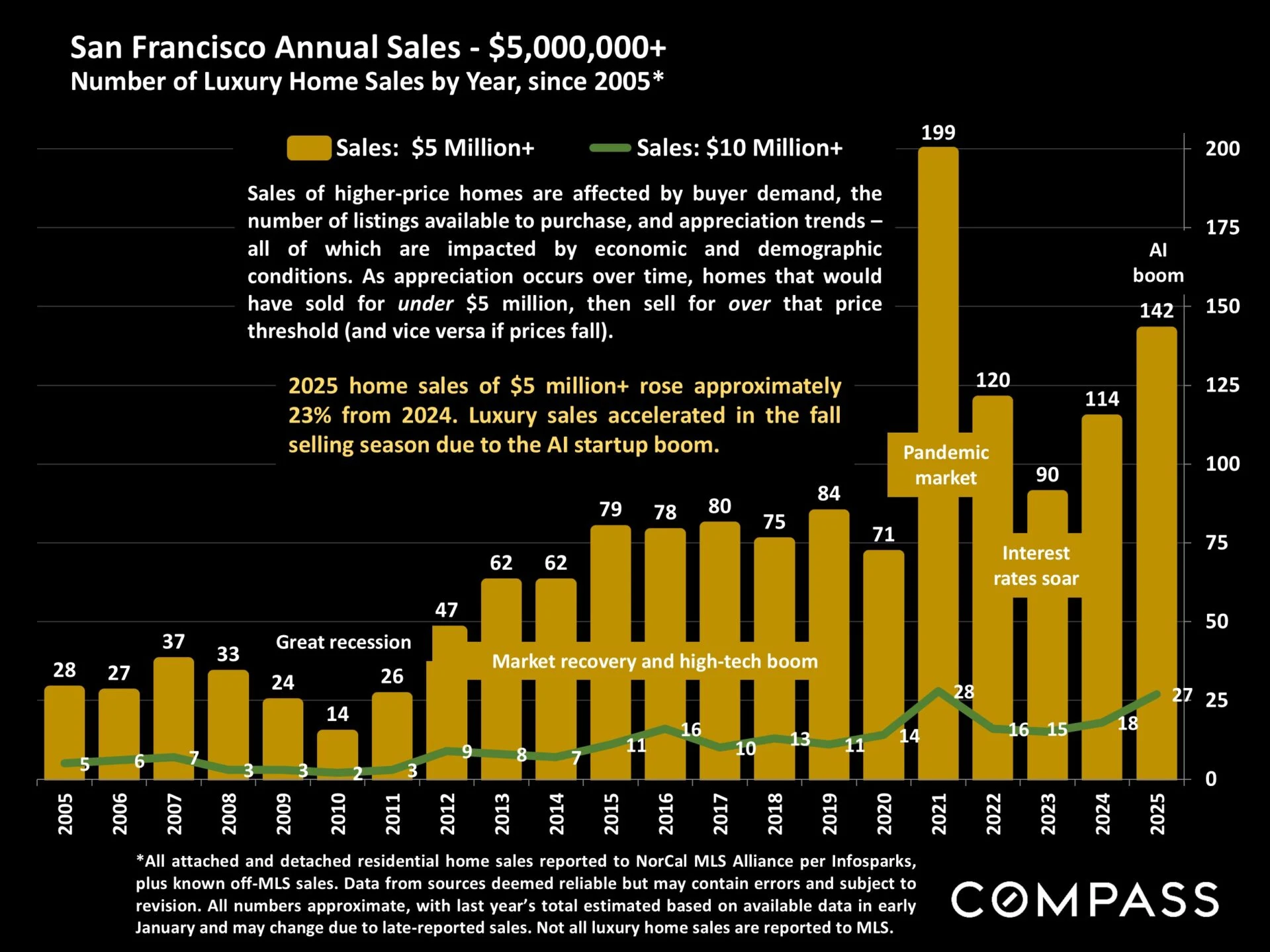

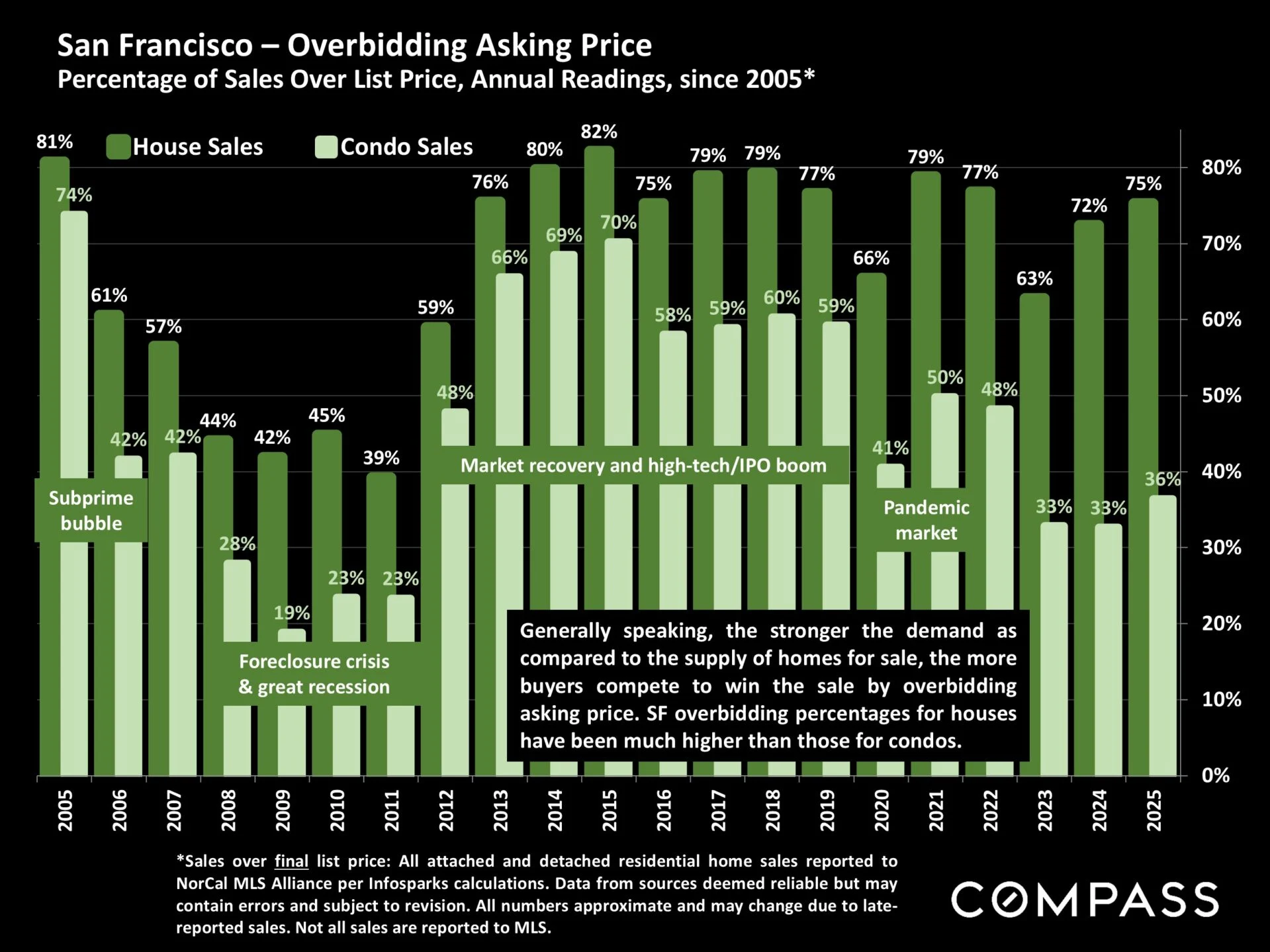

A lot of the heat we’re seeing is coming from AI (I know, I know… everyone is talking about it), but the impact is real. Buyers are moving fast because there’s a growing feeling that if they don’t buy soon, they’ll get priced out. And honestly, with prices rising at pretty unprecedented levels and more IPOs rumored for 2026, that fear isn’t totally irrational.

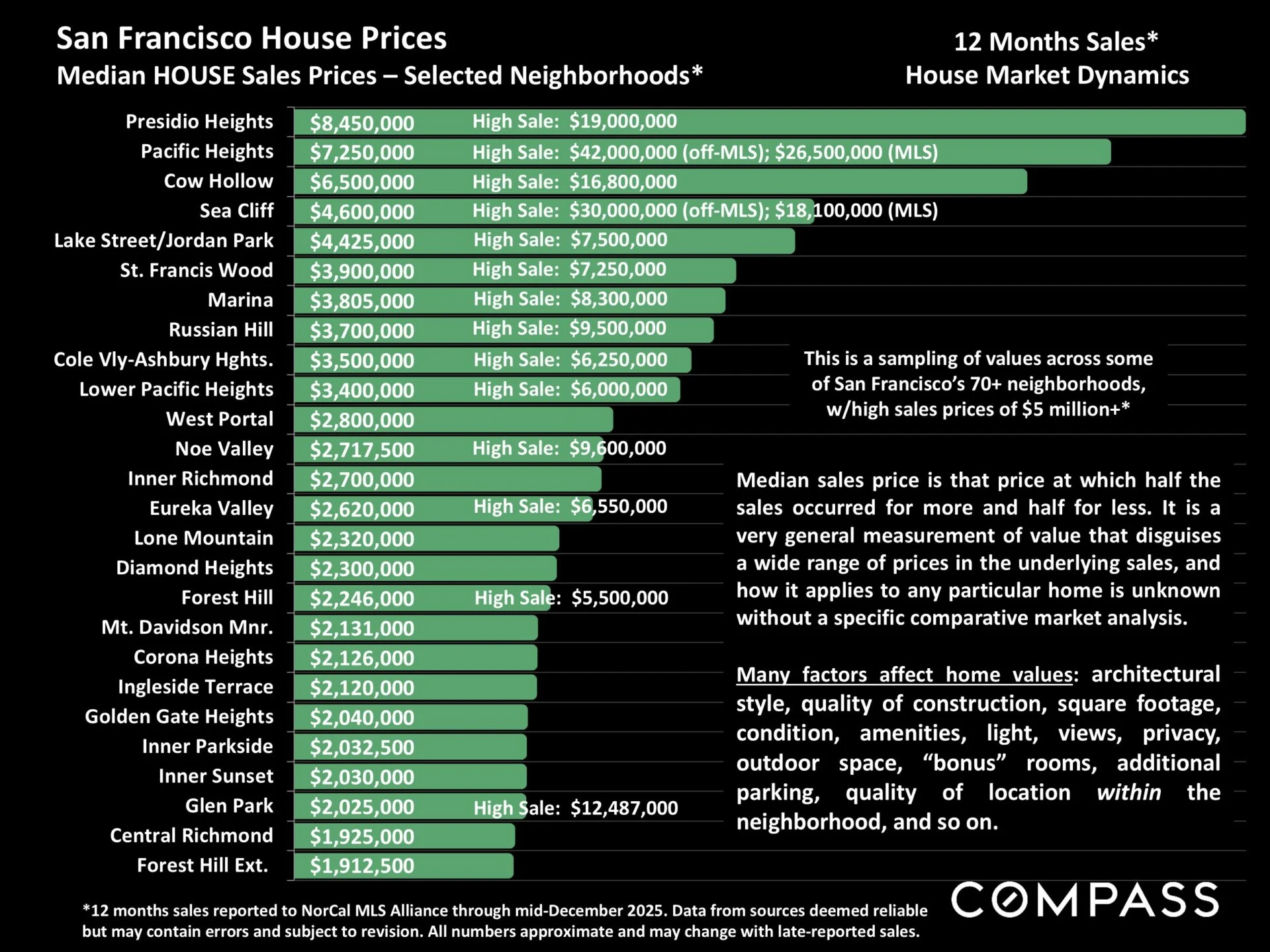

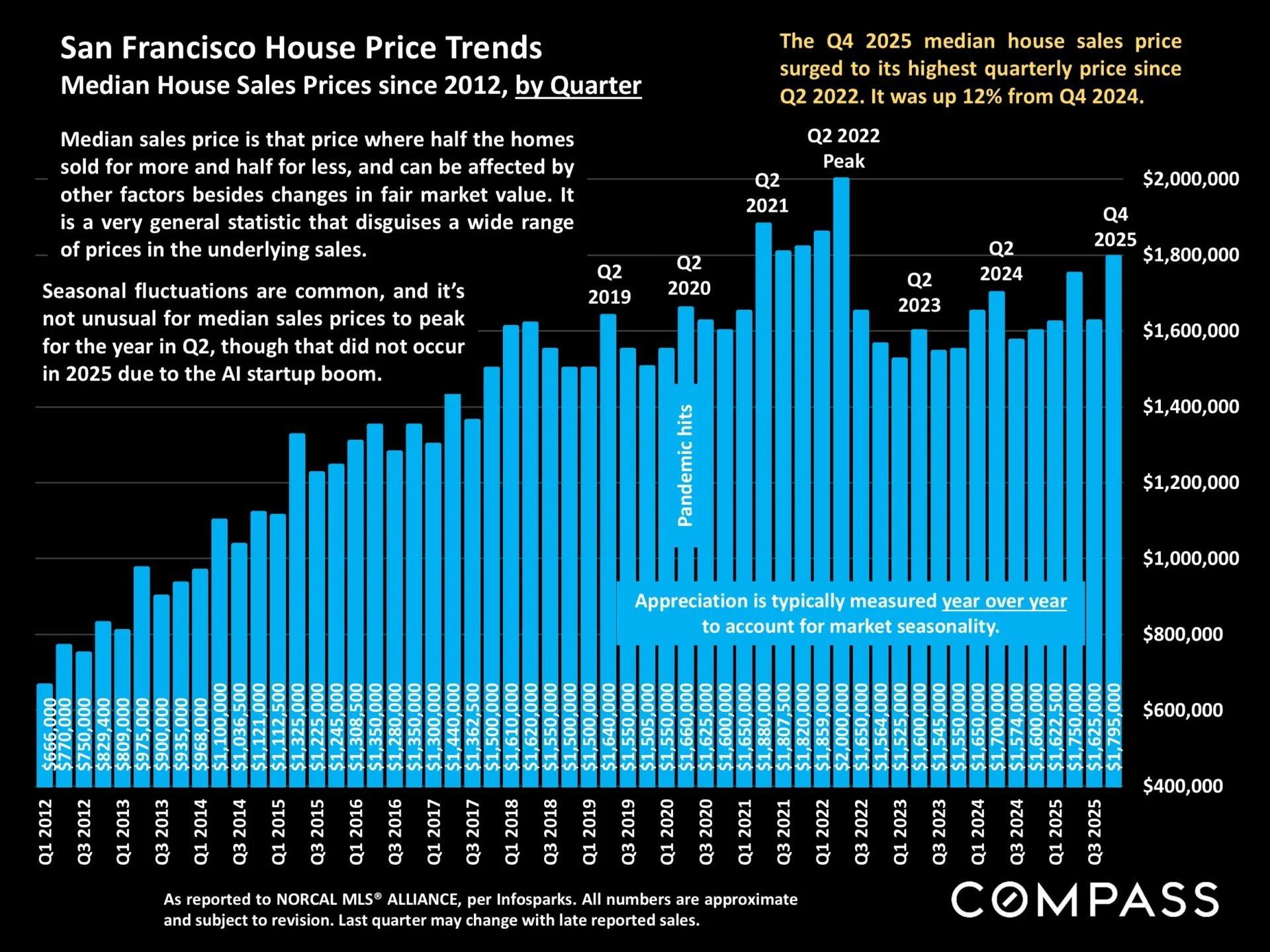

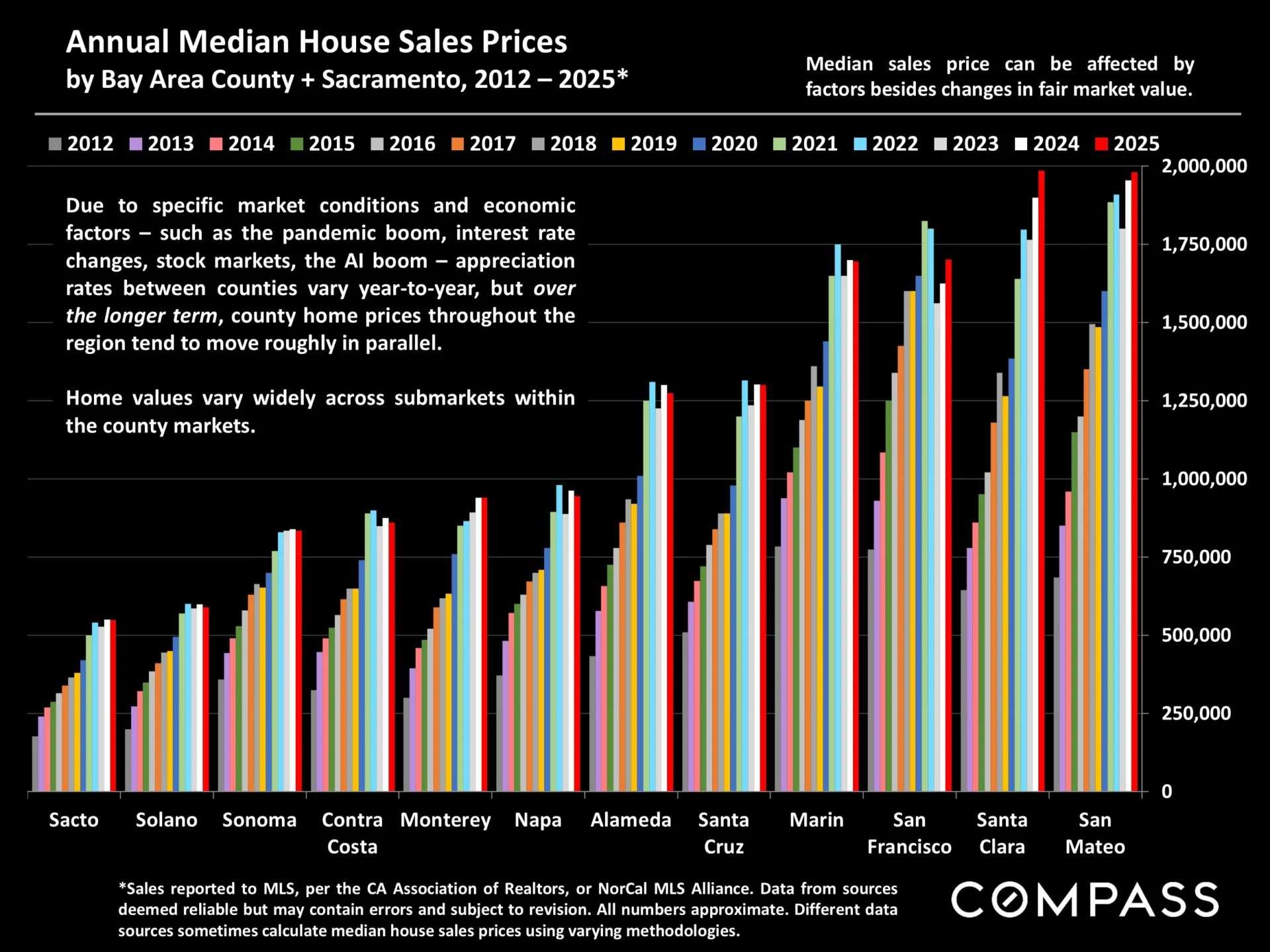

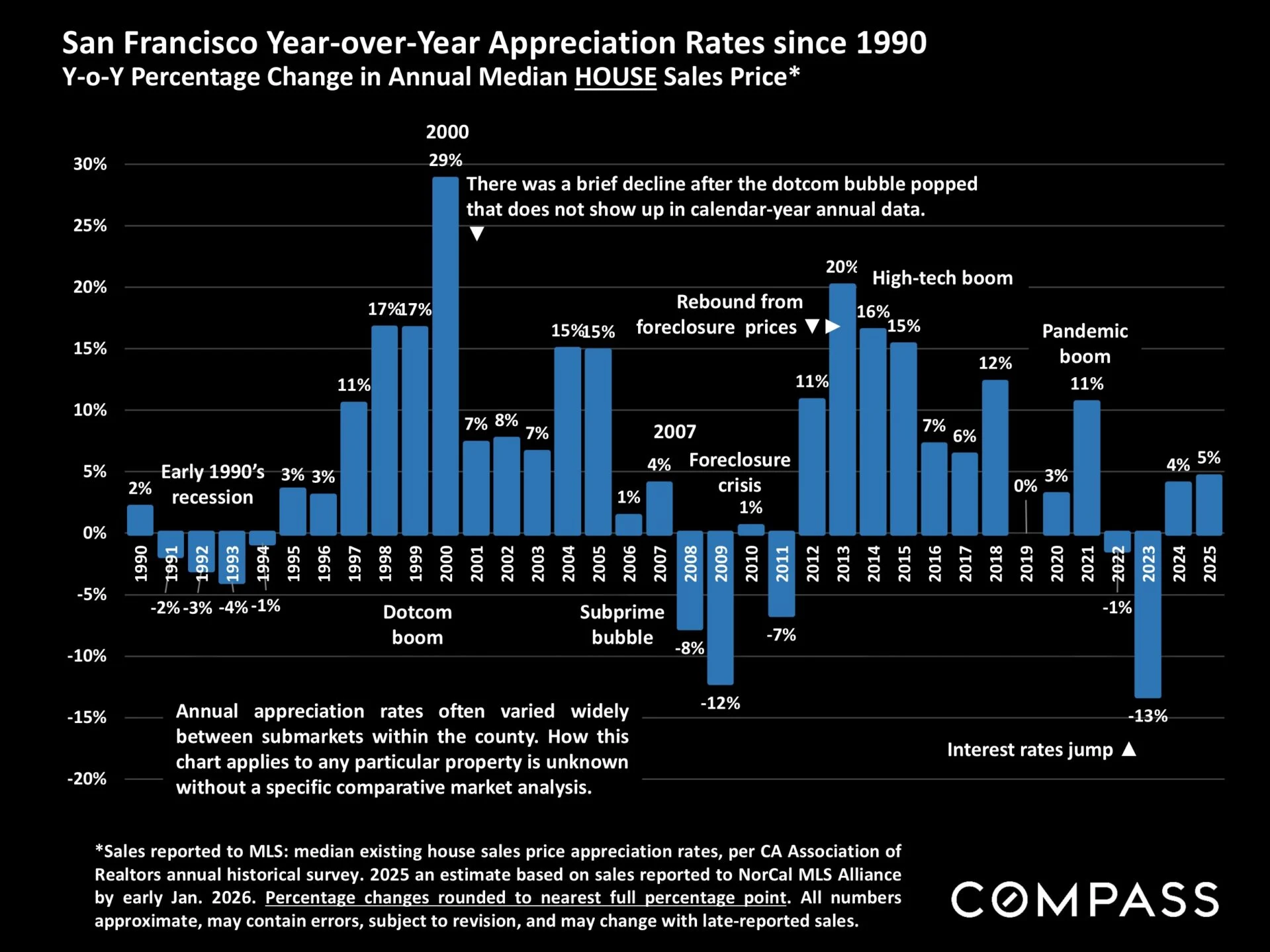

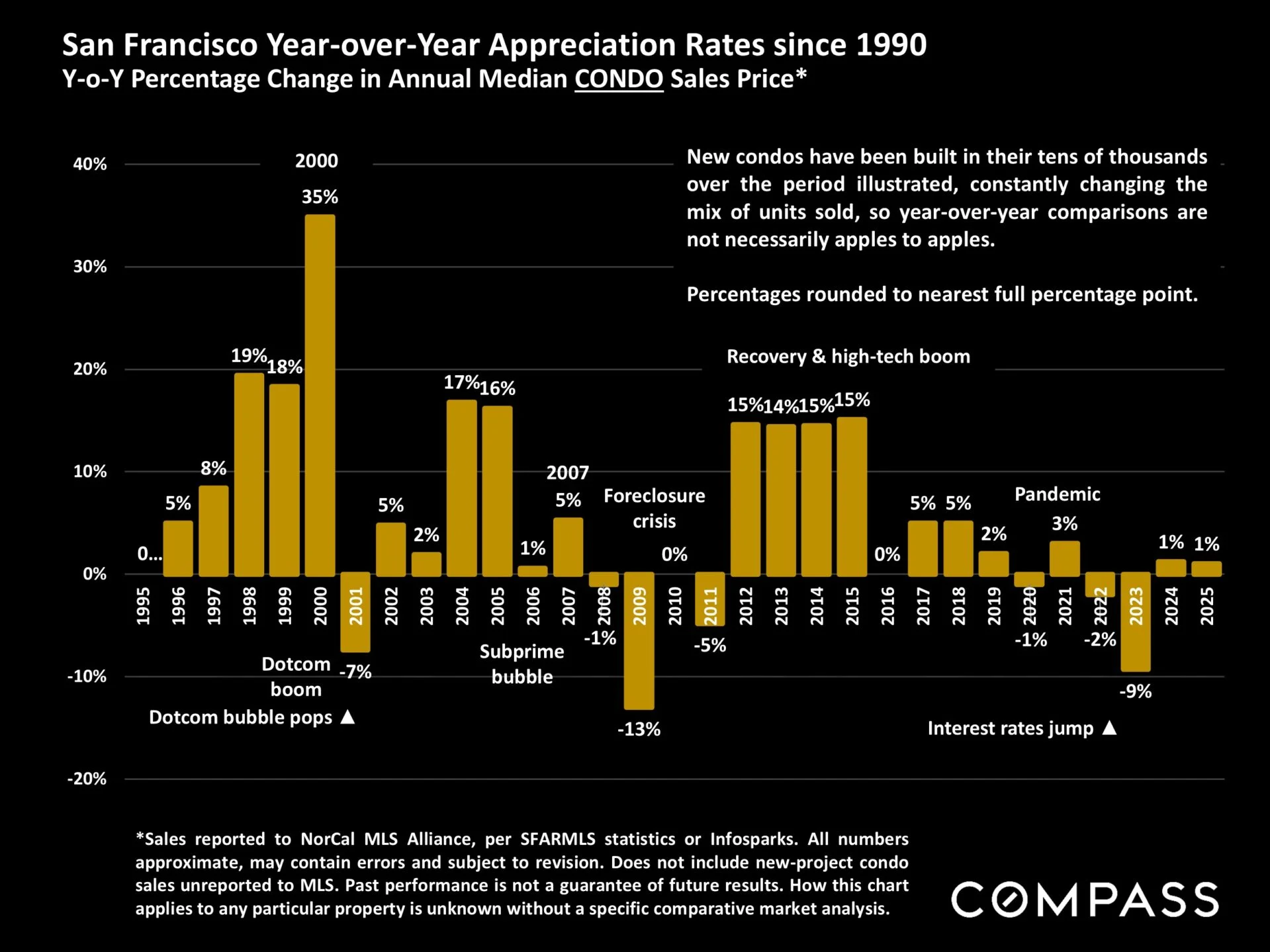

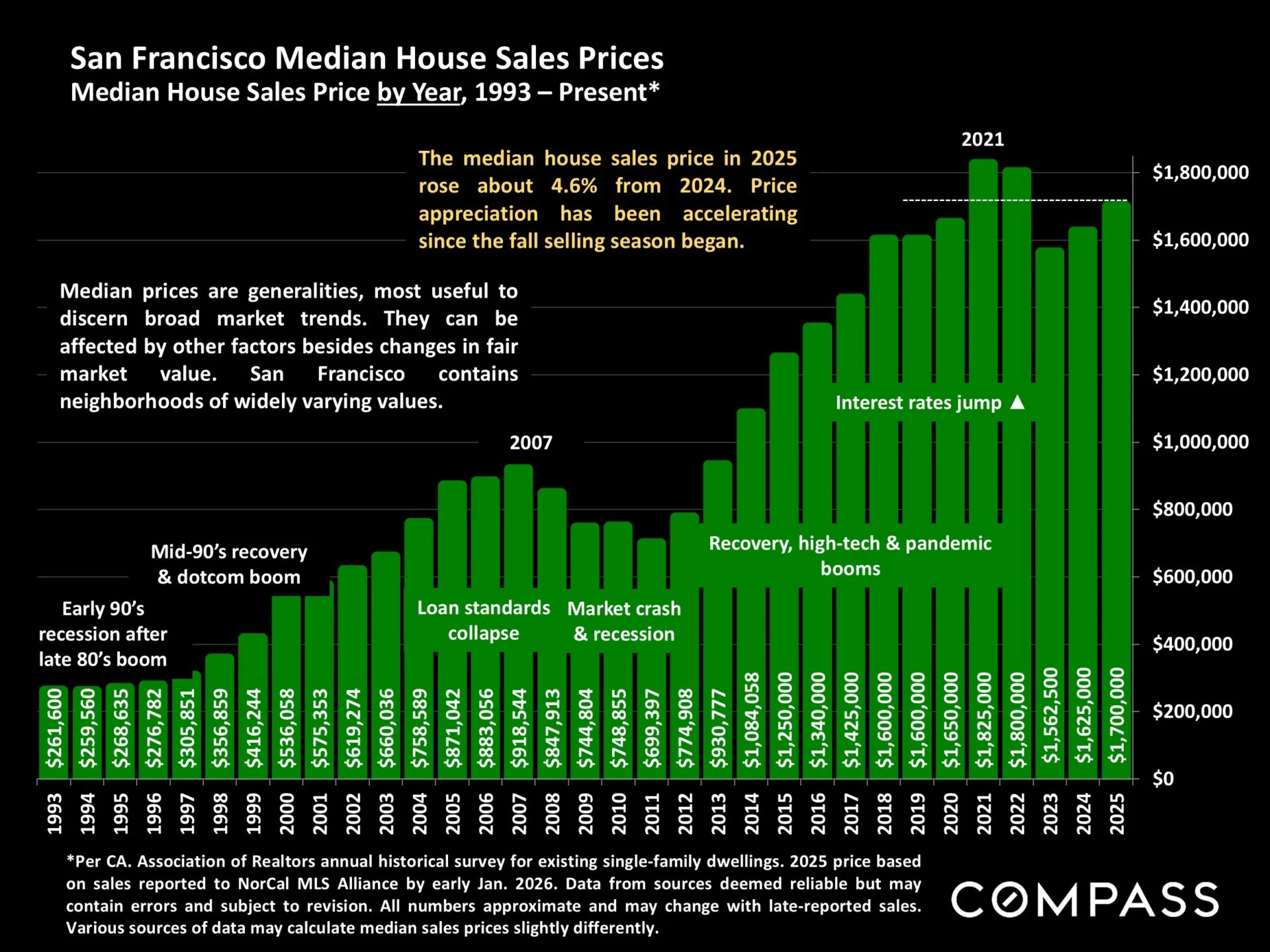

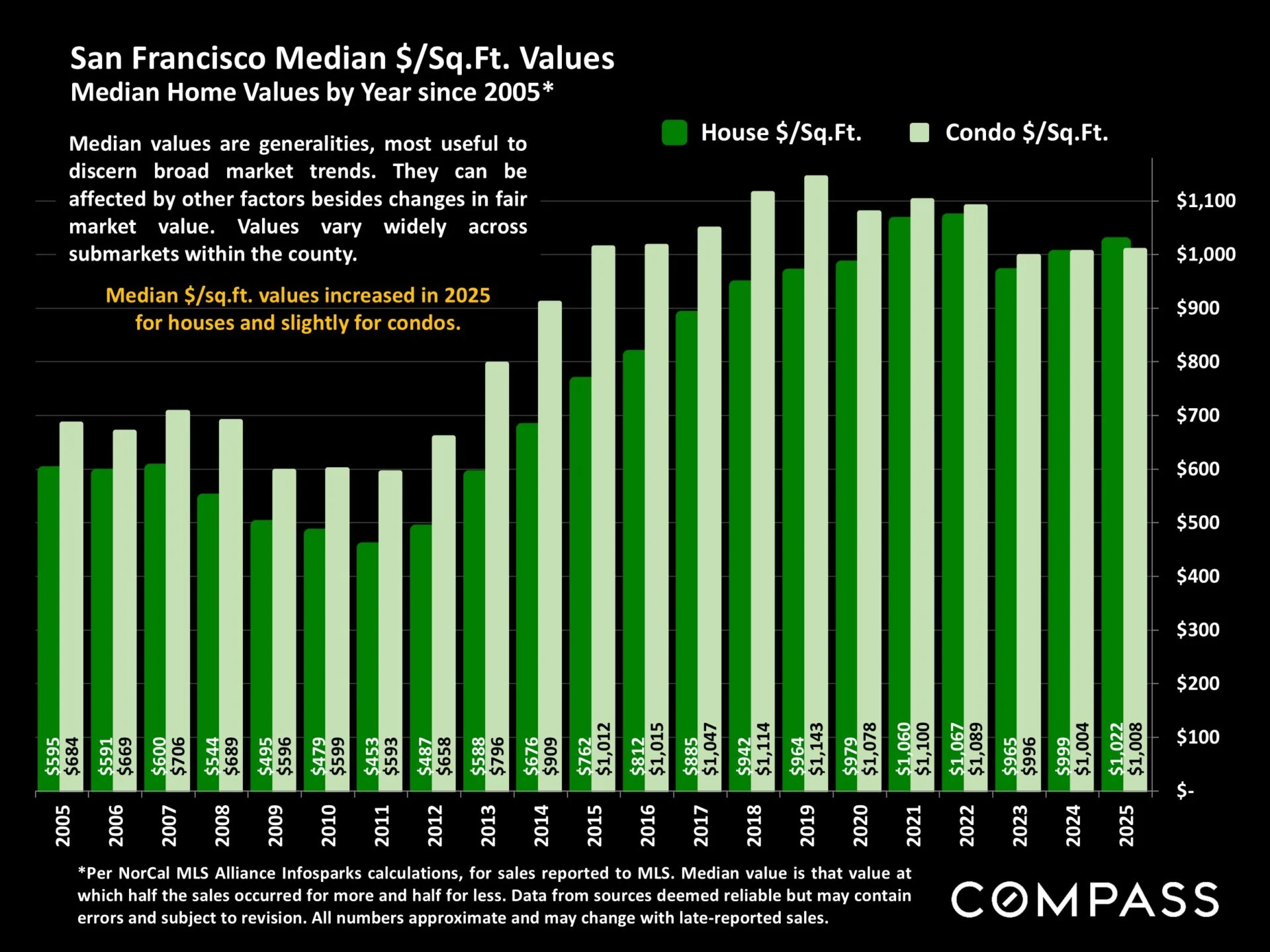

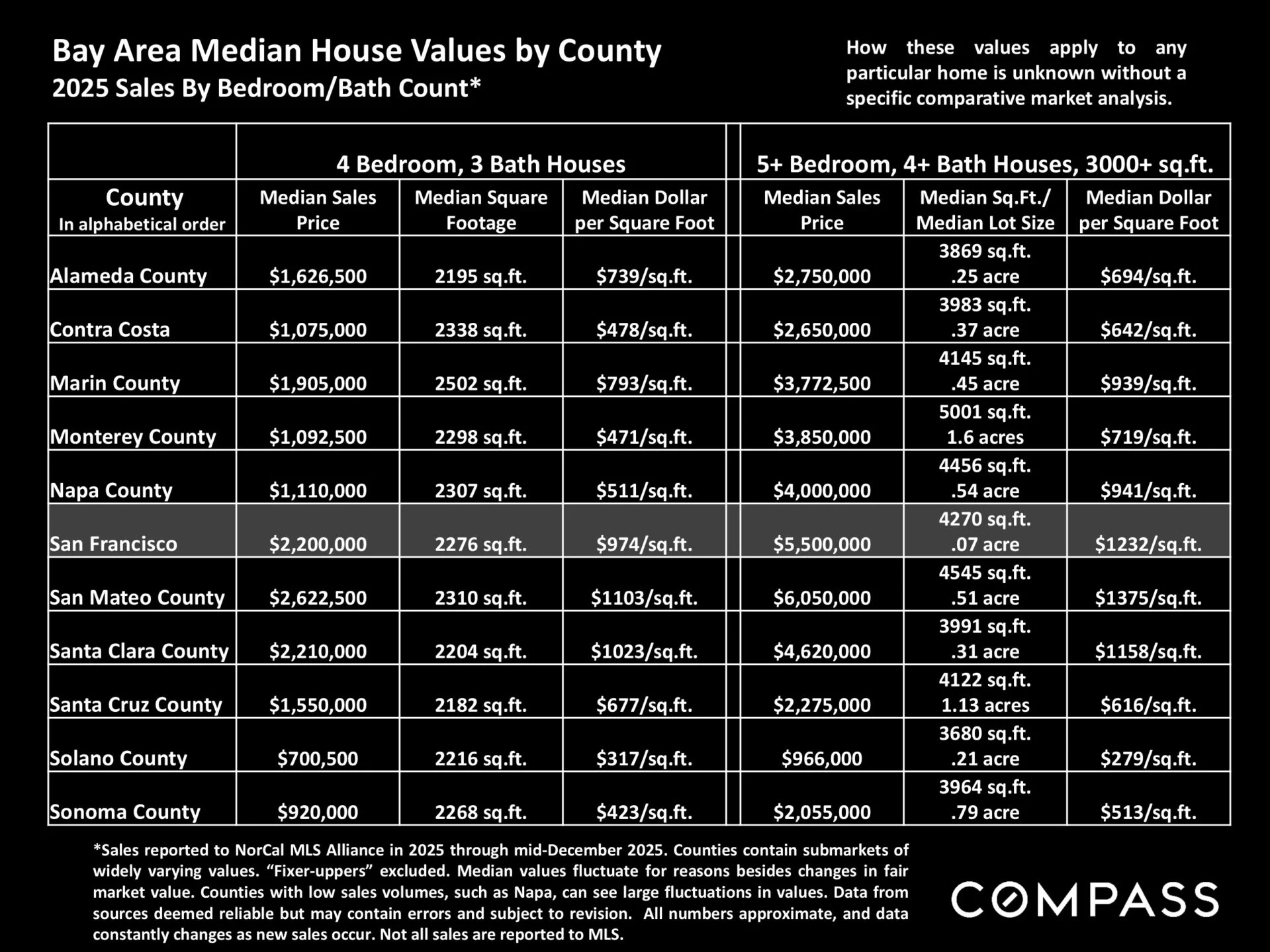

Across San Francisco, single-family homes are up 12.5% year-over-year. That’s significant growth, but here’s the silver lining for buyers: the median single-family home price is still below the 2021 peak.

So depending on what you’re buying and where, there may still be an opportunity to get in before we fully revisit those highs. But that window feels like it’s closing.

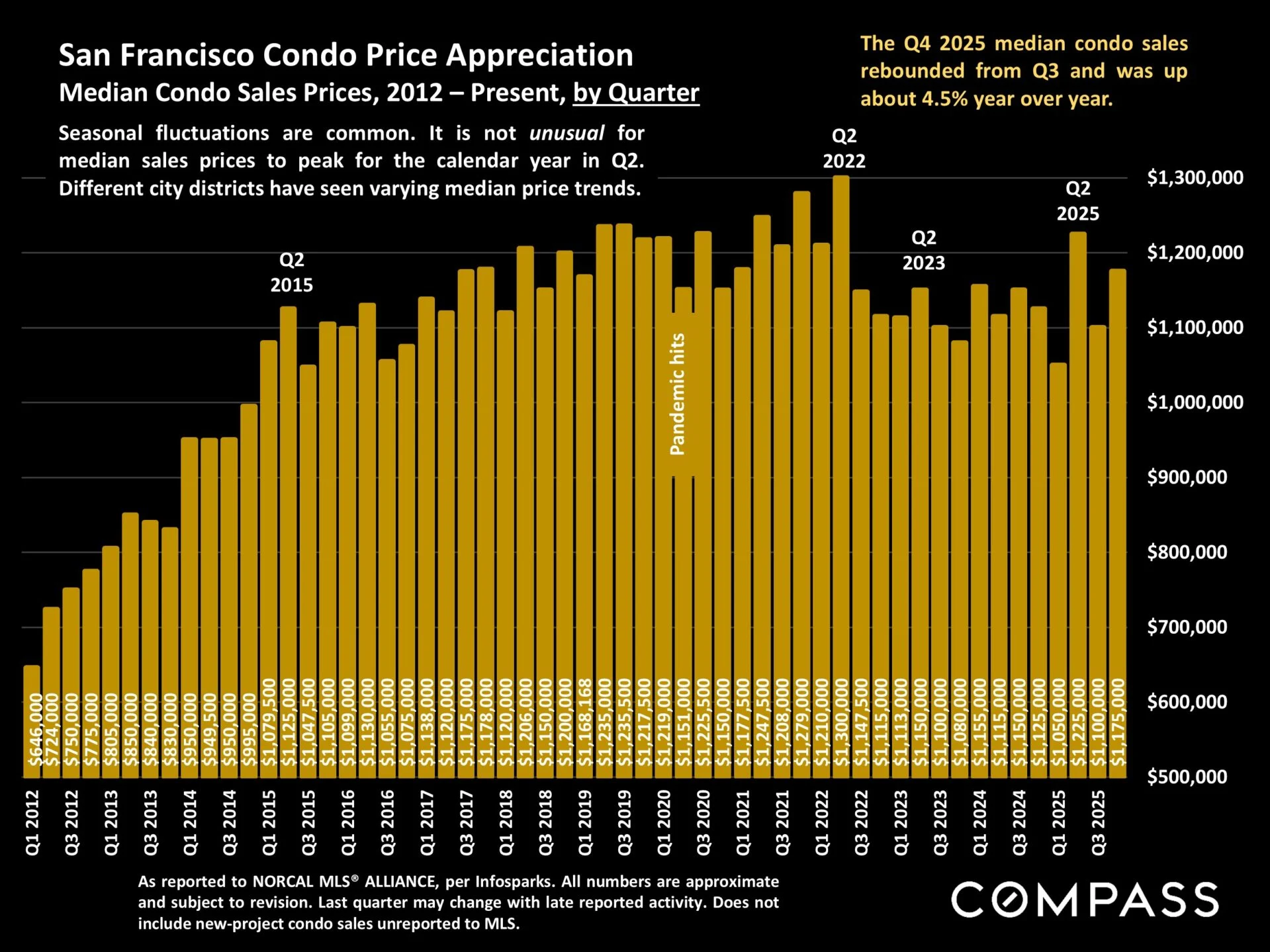

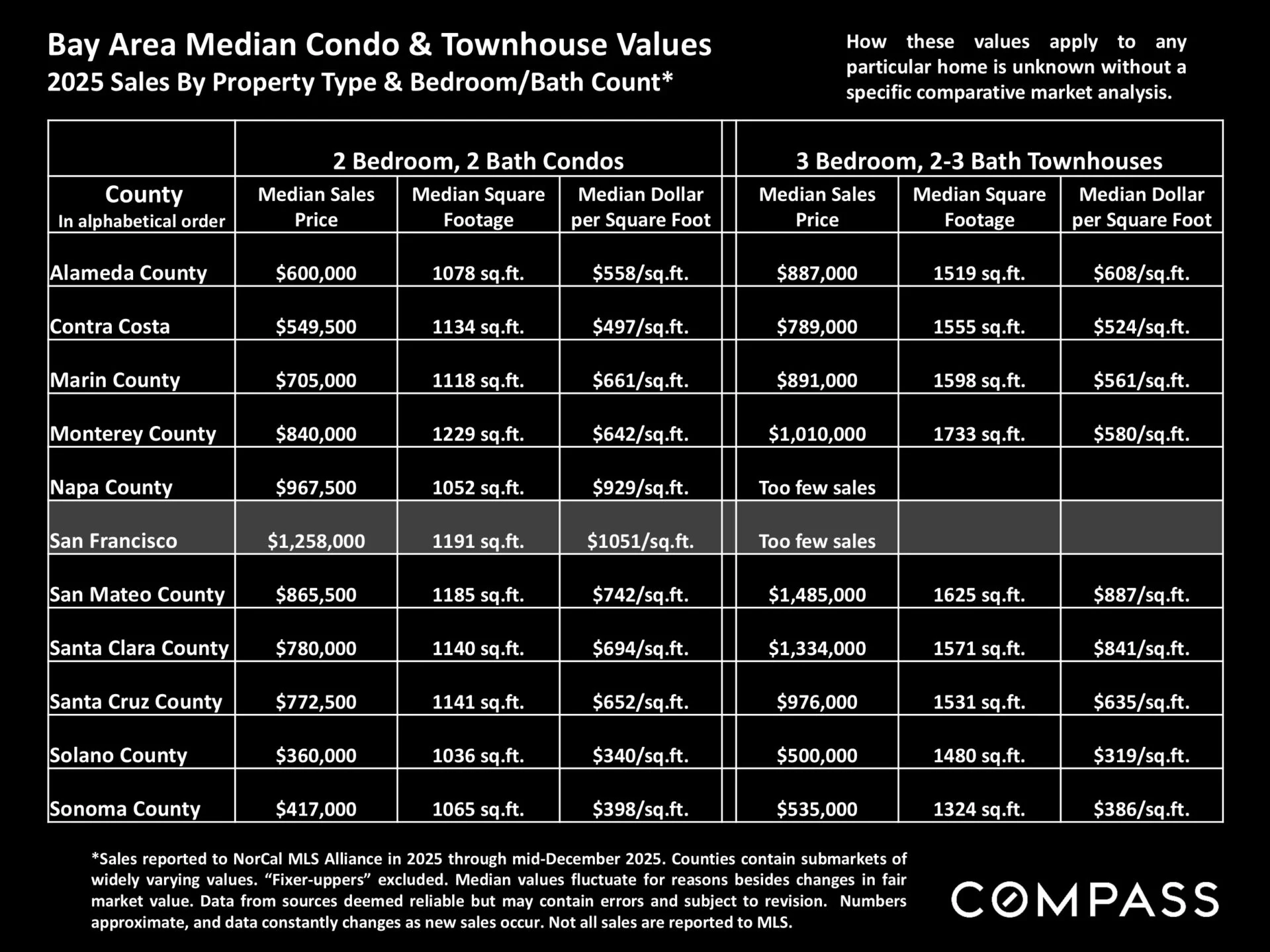

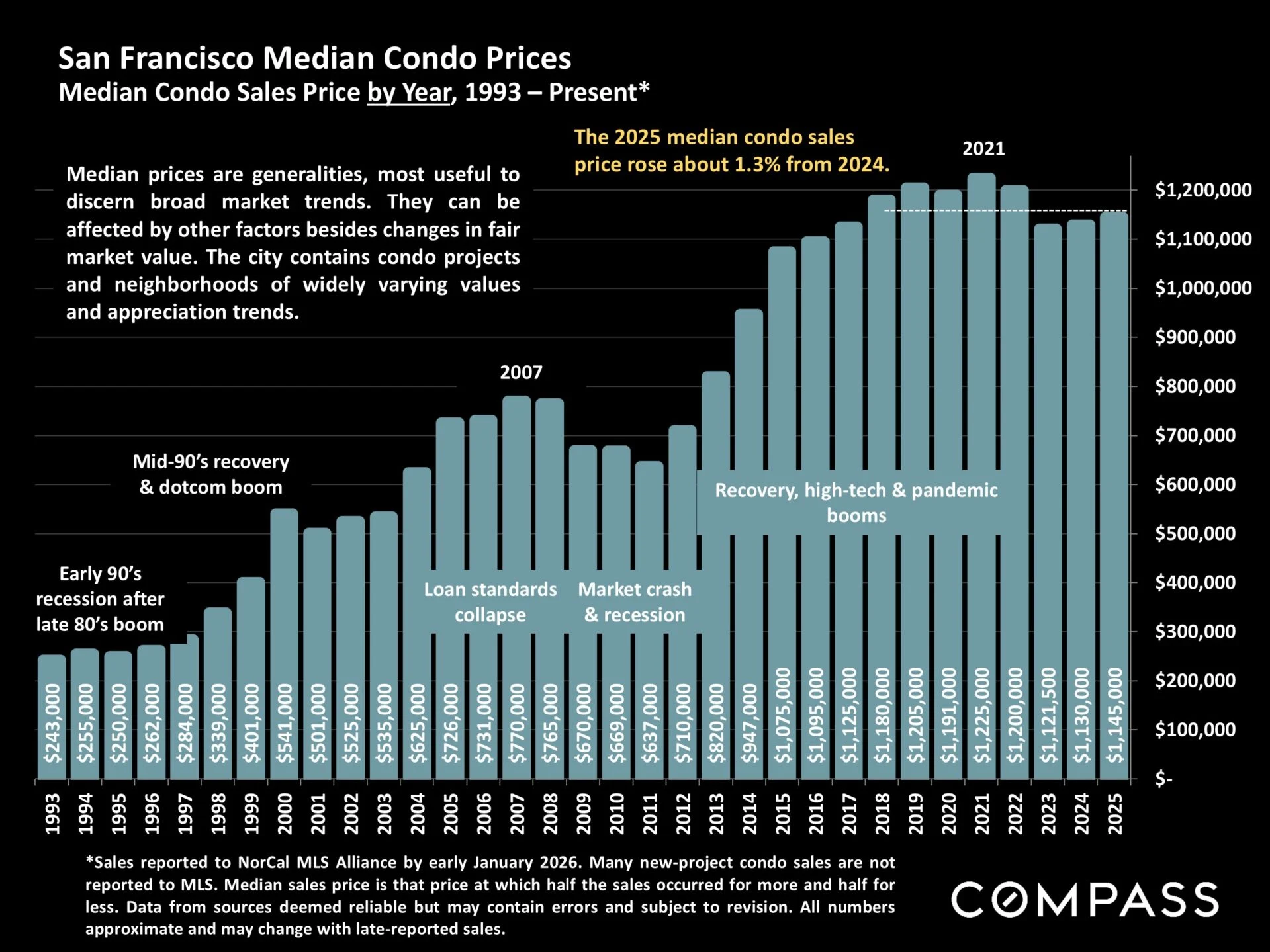

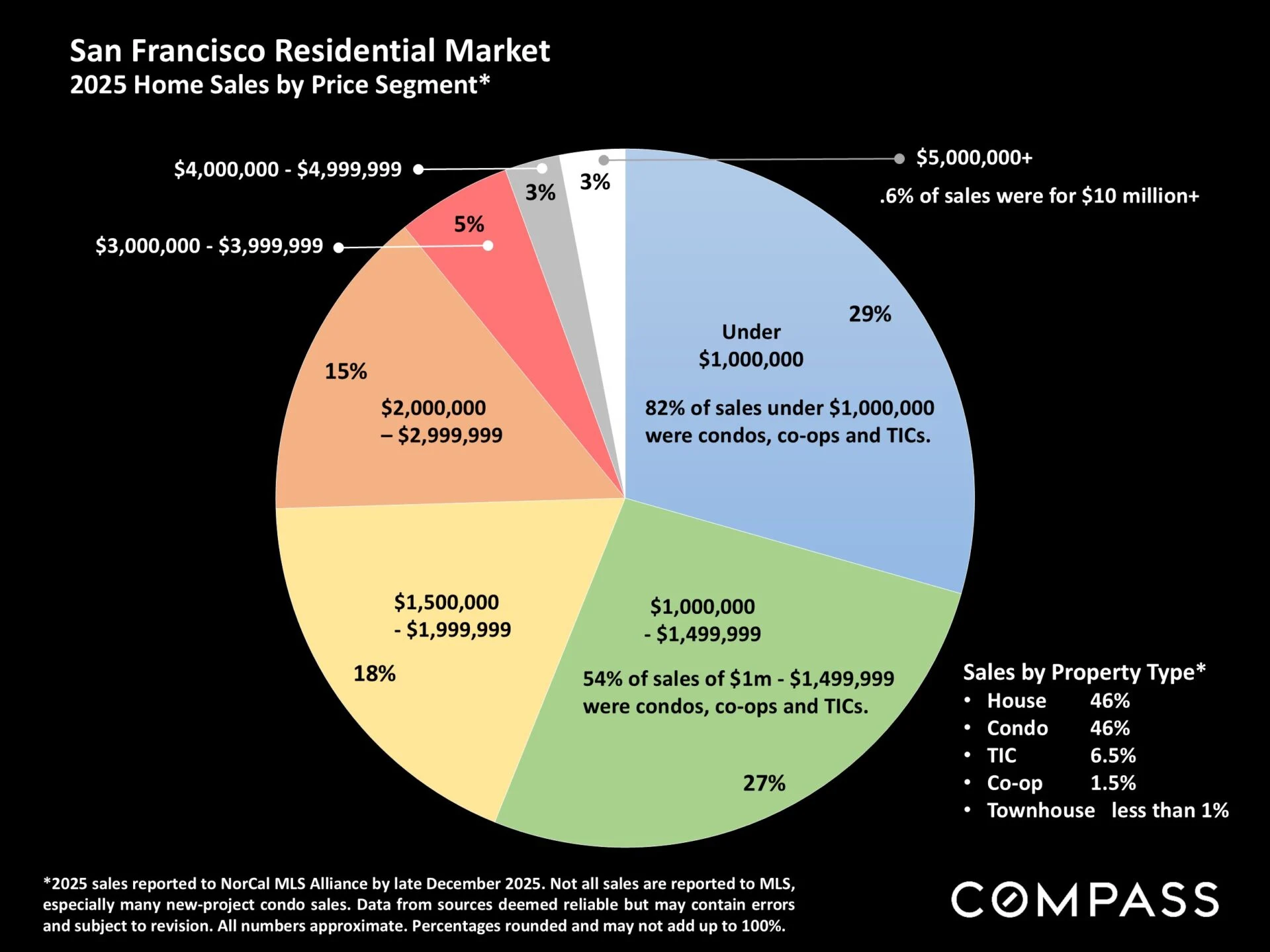

Condos are up only 1.3% — which is basically flat compared to single-family homes. Median condo pricing is sitting around 2018 levels, although it really depends on the building. Some are still discounted, and some are already climbing again.

The biggest shift I’m seeing right now: District 5 single-family homes, especially $4M+, are having a moment — and not a subtle one.

We’re seeing a few recent data points (last 30 days) that suggest prices are up more than 30% since last spring. These could be outliers — more to follow next month. But this is painful for buyers (I feel you)… and very, very exciting if you’re a seller in this category.

What’s driving this? A combination of things:

What’s different right now is that a lot of buyers who were thinking they’d buy “sometime in the next few years” are suddenly accelerating their timeline — because they’re genuinely afraid that if they wait, they’ll get priced out.

And I’m seeing this across pretty much every buyer segment:

The empty nester who has always wanted a home (or condo) in San Francisco

These buyers have been thinking about it for years. Now they’re finally pulling the trigger because they don’t want to look back in six months and realize they missed their window.

The early-career buyer who’s ready to buy instead of rent (often with help from parents)

This group is less interest-rate sensitive when they have family support for the down payment. They’re watching their rent go up 11% year-over-year and thinking: why are we still renting?

The long-time SF renter or move-up buyer who’s been waiting for the “perfect moment”

These are people who know the city inside and out. They’ve been watching and waiting… and are now realizing that moment probably already passed. The urgency is real.

I’m starting to think the multi-year condo discount period might be wrapping up sometime soon.

A lot of what dragged condo prices down was tied to downtown — empty office buildings, shifting demand, and weaker tech employment. But now we’re seeing a real change in momentum:

Rents are up 11% over the last year. That’s a big deal. When rents are climbing that fast, it changes the buy-vs-rent math pretty dramatically.

Office vacancy is back in line with pre-pandemic levels. Downtown isn’t empty anymore. That was one of the biggest psychological drags on condo values, and it’s reversing.

AI companies are expanding (and hiring). More high-paying jobs mean more demand for housing — including condos close to offices and transit.

If you’ve been thinking about buying a condo, I’d pay attention. The buildings that are still discounted might not stay that way much longer.

Yes, everyone is talking about AI. But here’s why it matters for real estate:

Actual job growth. AI companies aren’t just theoretically expanding — they’re hiring people with serious compensation packages. Those people need places to live.

IPO expectations. There are multiple AI companies rumored to go public in 2026. When those IPOs happen, you get wealth creation events that ripple through the housing market. People are buying now to avoid competing with post-IPO buyers later.

FOMO is rational right now. I know “fear of missing out” sounds like emotional decision-making, but when you look at the pricing trajectory — especially in certain neighborhoods — the concern about being priced out isn’t irrational. It’s based on what’s actually happening.

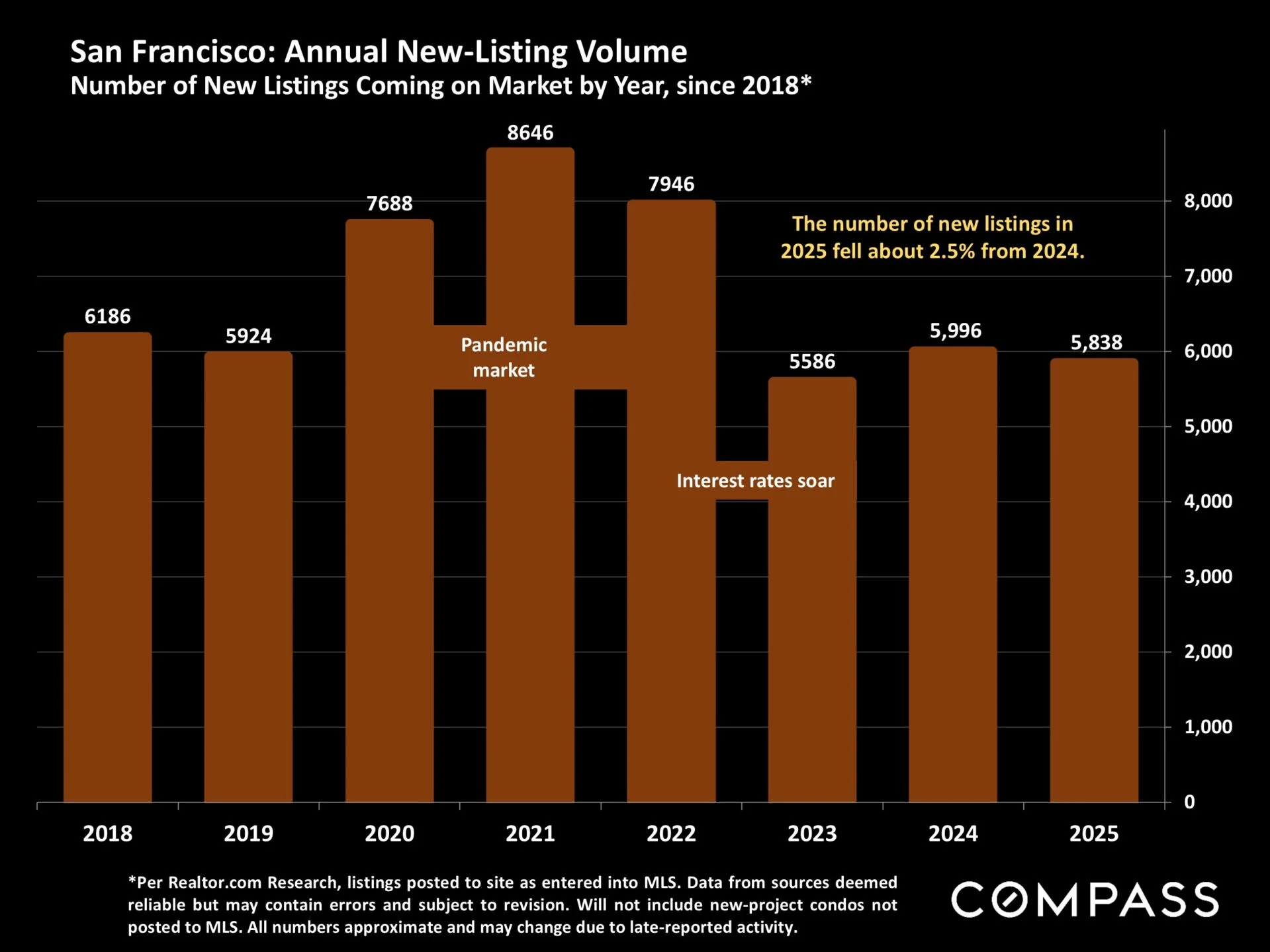

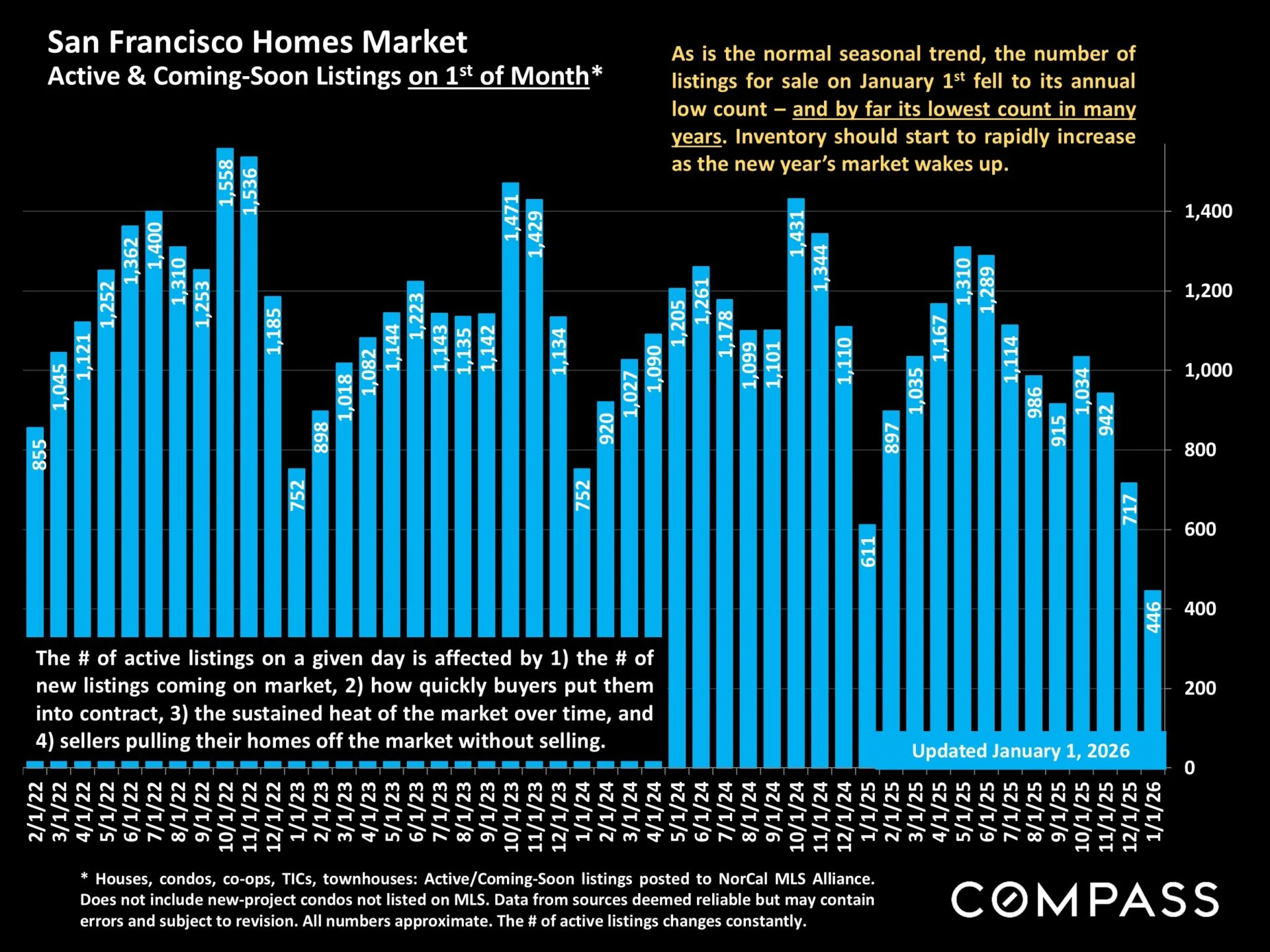

This is your moment. Inventory is tight, buyer competition is intense, and prices are climbing fast. If you’ve been on the fence about listing, now is the time to have that conversation.

You have options. If you need to sell now, there are buyers — but if you can wait 3-6 months and the downtown recovery continues, you might be in an even stronger position. It depends on your timeline and what you’re seeing in your specific building.

Expect competition. Expect to move fast. And know that while prices are up significantly, we’re still below 2021 peaks in many cases. If you find the right property, don’t overthink it — because someone else is probably looking at it too.

You might be looking at the tail end of the “condo sale.” Buildings that were heavily discounted are starting to tighten up. If you’ve been waiting for the perfect deal, you might want to define what “good enough” looks like and move on it.

“Are we back to 2021 prices?”

Not quite — but we’re heading that direction fast, especially in certain neighborhoods. Citywide, single-family homes are still below 2021 peaks. But District 5? Some properties are already there or beyond.

“Should I wait for prices to come down?”

I can’t predict the future, but I can tell you what I’m seeing: motivated buyers, limited inventory, strong economic fundamentals, and rising prices. Waiting makes sense if you think those conditions are going to reverse. If you don’t think they will, then waiting might mean paying more later.

“Is the condo market really recovering?”

The early signs say yes. Rents are way up, office vacancy is down, and buyer interest is picking up. If you’re thinking about a condo, I’d at least start looking now so you understand what’s available and what’s moving.

“How much are interest rates really helping?”

They’re definitely helping — lower rates mean more buying power. But honestly, the bigger story right now is buyer urgency. People are moving because they’re worried about being priced out, not just because rates dropped a point.

I think we’re going to see continued strength through at least the first half of 2026. The fundamentals are solid: good employment, strong stock market, declining rates, and real buyer demand.

Single-family homes, especially in the premium segments, are going to stay competitive. I don’t see inventory loosening up significantly, and as long as the AI industry keeps expanding, that demand isn’t going away.

Condos are the wildcard. If downtown continues recovering and more companies bring people back to offices, I think we’ll see condo values start climbing more noticeably. The buildings that are still at 2018 pricing won’t stay there forever.

If you’re thinking about making a move this year, buying or selling, let’s talk. The market is moving fast, and having someone who’s watching it daily makes a real difference.