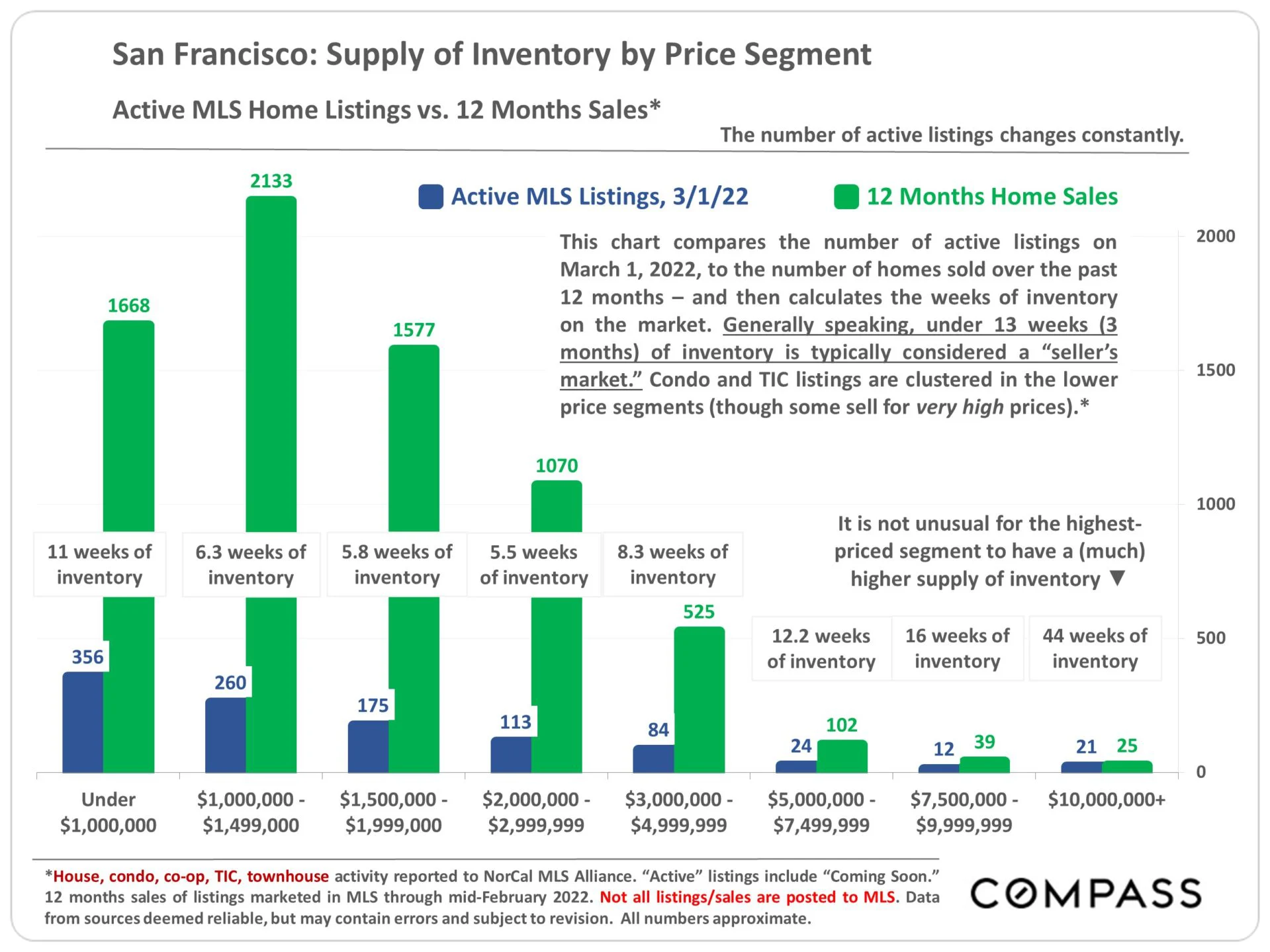

So far in 2022, Bay Area real estate markets appear largely unfazed by higher interest rates, volatility in financial markets, and troubling international events. The prevailing dynamic remains one of the strong buyer demand competing for an inadequate inventory of listings for sale: Crowded open houses, multiple offers, fierce overbidding, and fast sales remain common. That is not to say there haven’t been buyer negatively impacted by higher loan rates and/or recent declines in stock portfolios; and some buyers and sellers have become more hesitant or paused their plans, awaiting more clarity amid recent developments. But not enough to move the needle on the fundamentally high-demand/low-supply conditions which dominated 2021.

As typical at the start of the year, the number of new listings coming on market and the number of listings going into contract continue to rise. These normally climb rapidly through spring, characteristically the biggest selling season of the year. (Autumn is also a big selling season, but significantly shorter.)

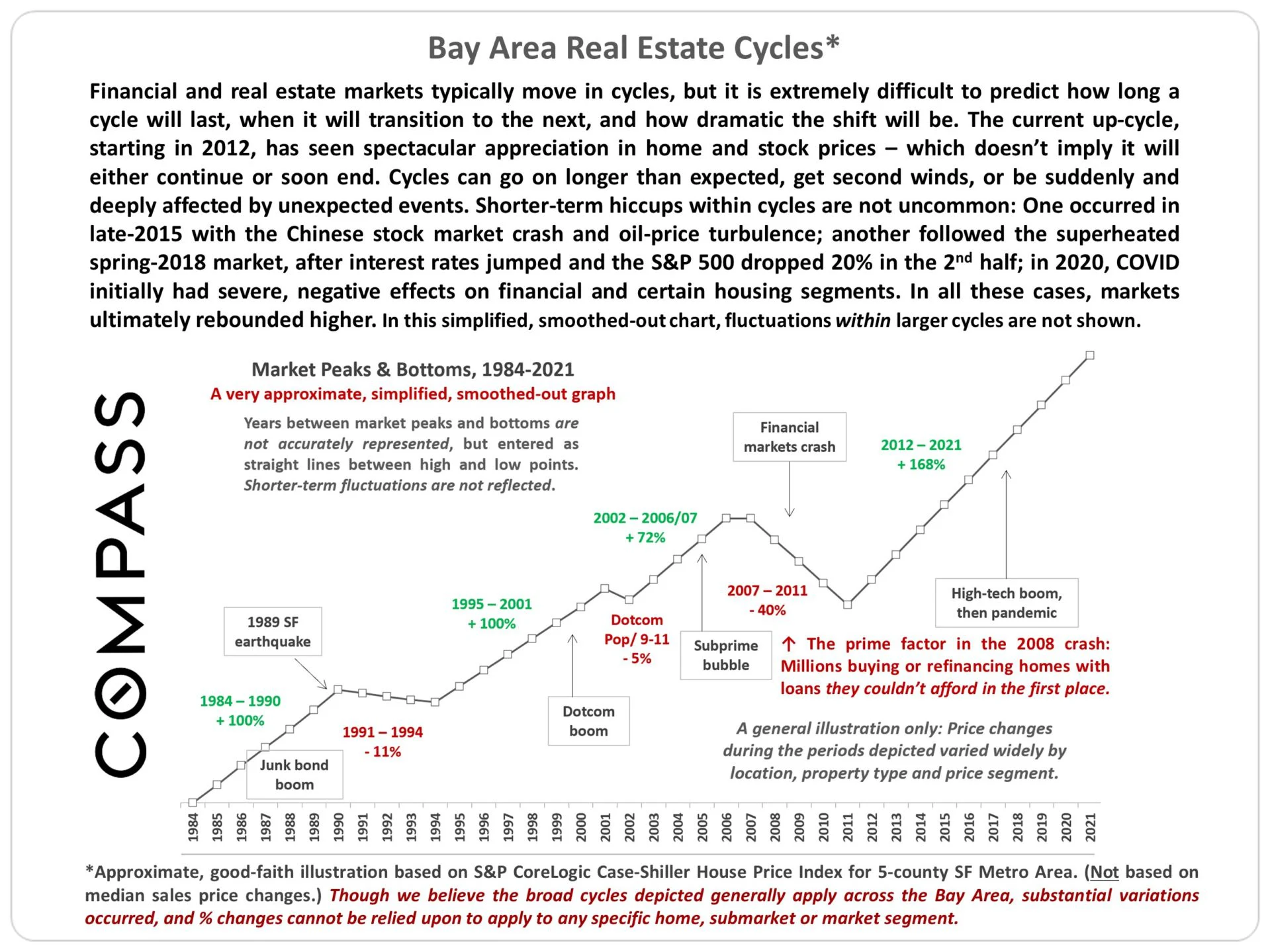

This post will review a number of standard indicators, as well as home values, interest rates, factors that can affect real estate markets, and how market cycles have broadly played out over the last 4 decades. March and April data will soon provide further indications of the market’s direction in 2022.