Ok, here’s something that’ll completely surprise you: Despite all the headlines about tariffs and market uncertainty – and I mean ALL the headlines, it was everywhere – the San Francisco real estate market had some of its strongest months this year.

My team and I have sold over $1 billion in San Francisco real estate over the last decade, and what I’m seeing right now completely goes against what most people think about summer buying. If you’re sitting there waiting for fall to make your move… I mean, you might be missing the opportunity of the year here.

Most people think summer means the San Francisco real estate market goes to sleep. I hear it constantly: “Ruth, should we wait until September when more inventory hits the market?”

Here’s the deal – and I cannot stress this enough – if you know what you’re doing, summer might actually be the BEST time to make your move.

You’re probably wondering why everyone thinks this way. It’s true that sales slow down in summer and there are going to be fewer homes to choose from over the next few months. But here’s what most buyers don’t get – and this is huge – the general lack of buyer activity can sometimes mean downward pressure on prices and less competition.

I mean, think about it. If everyone’s at Tahoe or wherever, and you’re the one buyer looking at a house… that seller needs to sell.

So the key question becomes: how do you find inventory when everyone says there isn’t any?

Here’s my pro tip that honestly most agents won’t tell you because they don’t have access to this stuff: make sure you’re working with a Realtor who has access to off-market properties. This is when sellers will often be willing to sell now versus wait until fall. If they’ve already moved out but don’t want to accumulate days on market – which looks terrible, by the way – this can be a great time to pick up a home without competition.

But look, there’s a lot to understand about buying off-market. They’re not all created equal, and I’ve seen people get burned. What clients always ask me is whether off-market deals are actually better deals. The answer is… it depends entirely on why the seller is motivated and whether your agent knows how to negotiate these things properly.

The last few months have felt like a complete financial news rollercoaster. If I’m being totally honest here, when things were at their absolute worst with all the uncertainty around tariffs and the stock market just tanking, I didn’t see any effect on the SF real estate market.

If anything, I kept wondering if I was the only one actually listening to the news.

Both April and May 2025 marked two of our biggest months ever, and I’m talking about this while some news outlets were reporting the worst consumer confidence since the pandemic. I mean, what?

Here’s the actual data that shocked me – and I don’t get shocked easily: we closed 15 transactions in May alone. Fifteen! And median sale prices in San Francisco were still rising month-over-month.

But here’s where it gets really weird – and this is something I’ve never seen in my decade of selling SF real estate. Just as the tariff thing started to calm down and the stock market heated up, our market felt like it was slowing down. Odd, I know, right?!

We had a few listings that were way harder to sell than they would have been even just weeks before. I’m talking about houses that should have been slam dunks. But through some strategic marketing shifts – and I mean we had to get creative here – we managed to sell

The thing we learned through all this craziness is that when markets shift, it doesn’t happen to all products in all neighborhoods at once. Of those 15 transactions we got done in May:

All four that were at or below comps sold in the latter half of May as opposed to the beginning of May, which is honestly a bit of a head scratcher since this is actually when the stock market recovered. I still don’t totally get it.

The numbers are interesting though: homes going into contract in May rose 10% year-over-year, but we saw a 17% increase in price reductions over the same time last year. What this told me was that sellers were feeling the market shift and quickly trying to get their homes sold before summer hit.

You’re probably wondering how luxury buyers are dealing with all this economic uncertainty. The answer honestly surprised the hell out of me: the luxury market for 2025 has been remarkably strong.

We just recorded the highest number of sales for homes over $5 million than we’ve had in any single month in 3 years. That’s 23 luxury transactions in May 2025 alone. Compare that to 14 in May 2024. I mean, that’s not even close.

Stock markets are sitting very close to where they started 2025, and look, we hope to see continued strength throughout the summer and into fall. Interest rates have been all over the place – they went up, they went down, but they’re currently lower than when the year began and slightly higher than their lowest point in May. Most of our luxury clients are locking in rates in the low 6% to mid-6% range right now, which honestly isn’t terrible.

Here’s something I noticed that I found really interesting: luxury buyers aren’t just buying – they’re buying fast. The average time on market for homes over $3 million dropped from 67 days in 2024 to 41 days in 2025. These people are making decisions quickly.

I get asked all the time what neighborhoods hold their value the most during uncertain times. The data shows that areas in and around Pacific Heights have barely moved up or down since 2021, which is actually pretty impressive given how much interest rates have changed.

But here’s where it gets really interesting – and this is going to blow your mind because it goes against what most people think about “hot” neighborhoods.

Based on how fast homes are selling in the last 90 days, here are San Francisco’s three hottest neighborhoods:

Pacific Heights actually ranks at the bottom of this list. So “hot” should not be confused with the best place to buy – it’s way more complicated than that.

What “hot” means in these charts is speed of sale, which is often – but not always – telling you how low the homes are priced to begin with. Some neighborhoods, the best strategy is to list low and let people fight over it. At higher price points, this doesn’t always work because… well, rich people don’t like games as much.

I have been saying for at least a year that the Sunset was undervalued. It had dropped quite a bit in 2022, but it’s definitely on the rebound now. I’ve seen some sales over there that are far exceeding what other similar houses have sold for, so that “sale” pricing might be coming to an end.

The numbers back this up: the Sunset, Parkside and Golden Gate Heights not only sell fastest – 19 days average – but also have the highest percentage of homes selling over asking price at 89%. Eighty-nine percent! Compare that to Pacific Heights, which is usually priced more realistically from the start – listings there take an average of 52 days to sell and only 35% sell over asking price.

What people always ask me is whether this means they should avoid Pacific Heights entirely. Look, it’s complicated. One thing I’ve noticed about Pacific Heights is that when the market slows down, the sellers there just… don’t sell. The more money you have and the bigger your home is, the easier it is to just wait out whatever uncertainty is happening in the market.

Through all this market craziness, I keep mentioning some areas that I think are still on sale – one is Bernal Heights and the other is the Mission.

We recently sold a home in the Mission that absolutely crushed what comparable houses had sold for, but I think that was partially because it was a very special house on a very special street. Plus we had some really powerful negotiation strategies happening. So I’m not sure that one sale sets a new trend, you know?

You’re probably wondering what makes a negotiation strategy “powerful” in today’s market. What we’ve figured out is that in neighborhoods where there’s still reasonable inventory, buyers have way more leverage than they think – but only if they know how to use it right.

After looking at all our transactions this year here’s what we’ve learned:

On a completely random but exciting note: I saw a report that Muni ridership has recovered to post-pandemic highs. This might not seem real estate-related, but I think it means people are actually coming back to work and back to San Francisco in general, which is great news for our real estate market… though if you’re riding Muni daily, you might have mixed feelings about this.

For the next few months, it’s going to be hard to make complete sense of what the real estate market is doing because summer always feels weird. This year, it felt like summer started about three weeks earlier than usual, which threw everyone off.

But here’s what I’m confident about: if you’re a buyer who can move quickly and you’re working with an agent who actually gets these neighborhood dynamics and has access to off-market stuff, summer 2025 could be your secret weapon.

Ready to talk about your move to or within San Francisco? My team and I have sold over $1 billion in real estate over the last decade, and we’d love to help you figure out this crazy market. Call, text, or email – let’s talk about how all this applies to what you’re trying to do.

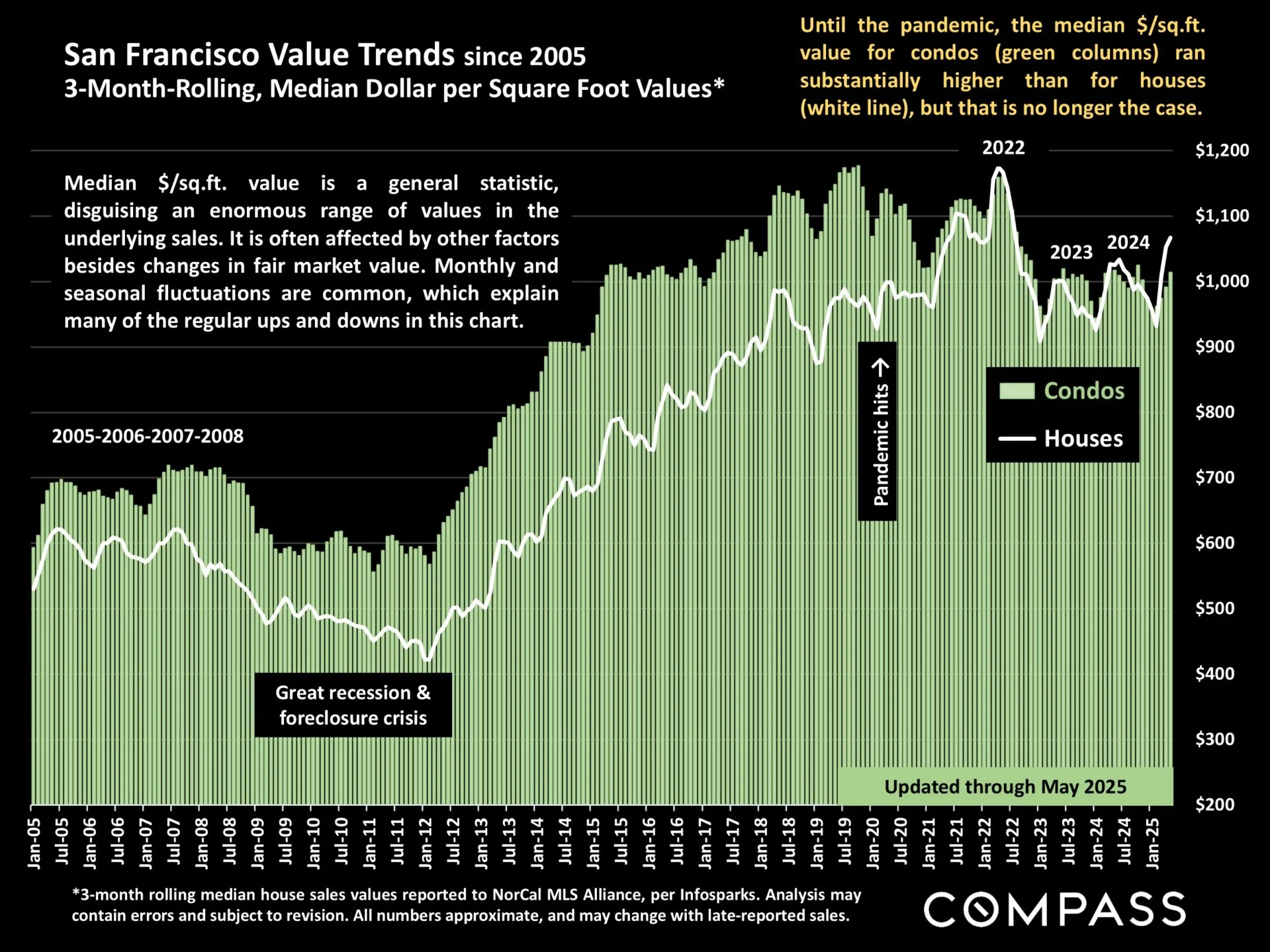

Market Data & Charts: Below you’ll find detailed charts and graphs with San Francisco real estate market data.